Irish Rent Collection Agent

Nominate Rentax by Taxback as your resident Rent Collection Agent for income earned on Irish property rentals. Our team will ensure your tax withholding obligations are met in accordance with Irish revenue standards. We are here to provide a rent collection service to non-resident landlords and property investors in Ireland. We can also assist in preparing and filing your end-of-year tax income tax return.

Get startedNon-resident landlords

Who is considered a non-resident landlord?

If you live outside Ireland (including in Northern Ireland) and you are earning income from a property in Ireland, you will be considered a non-resident landlord.

Non-resident landlords must declare any Irish rental property income to Revenue via an annual tax return Form 11. Where the property is jointly owned, both spouses should file separate tax returns and report their part of the rent separately.

Supporting non-resident landlords

We understand Irish tax law so you don’t have to. Taxback is an established and trusted industry name in Ireland.

By nominating us as your Irish Rent Collection Agent, you can rest assured your tax obligations are being met in accordance with Revenue. Our tax experts will also guide you through filing your end-of-year self-assessed tax return, ensuring you minimise your tax liability by claiming available expenses and reliefs.

What do Taxback offer?

Trusted agent

We have been the Irish tax experts since 1996!

End-To-end process management

Our tax specialists will manage the entire process from start-to-finish – ensuring you’re meeting your tax obligations and guaranteeing your tax compliance with Revenue.

Quality service

Our ISO 9001 certification is an external validation of our strong commitment to quality, our customers, partners and staff. The certification also gives you, the customer, the peace of mind that we are committed to providing a secure, quality service set out to the highest standards.

Multi-lingual live chat support

Got questions about tax? Our team are here to support you at every step in the process via phone, live chat and email. You can contact us at any time with your questions and we have a range of multi-lingual supports available to you.

Speak to our Team

What is a Collection Agent?

A tenant, living in a property that is owned by a non-resident landlord, is obliged to withhold 20% of the gross rental income (before expenses) and pay this to Revenue.

Alternatively, non-resident landlords can choose to appoint an Irish Rent Collection Agent – such as Rentax by Taxback – to manage these responsibilities.

Before July 2023, Collection Agents used to be issued with a separate TRN for the Collection Agent activity. However, from 1 July 2023, every month, Collection Agents must remit 20% of the gross rental income to Revenue on behalf of the non-resident landlords. The non-resident landlord can choose which option they prefer.

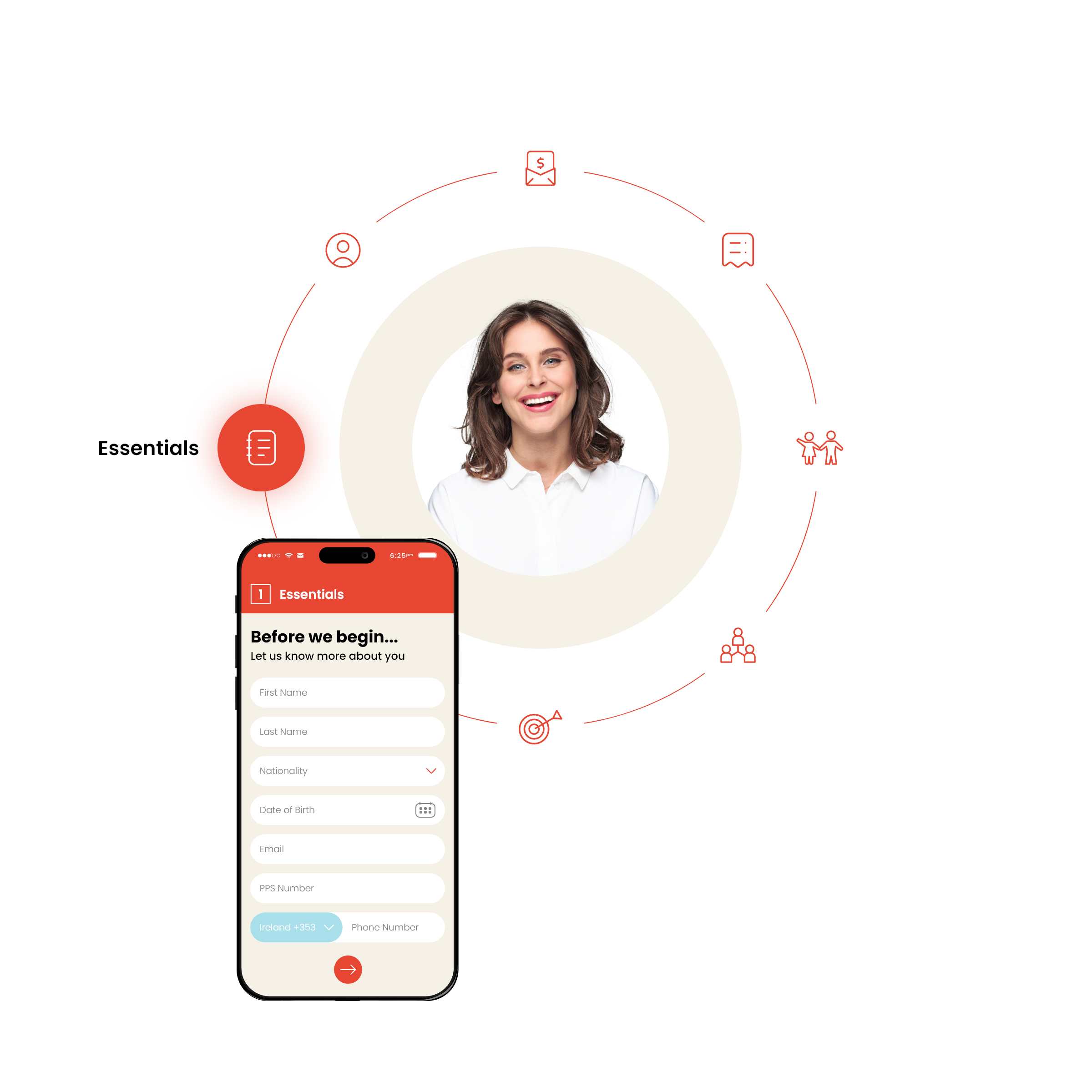

How it works

Rentax by Taxback will send you the relevant documentation, you sign it and return it to us, and we will sign with Revenue as the Collection Agent on your behalf.

For 2022 and 2023, we will be issued with a separate TRN number on behalf of the non-resident landlord. If collecting rent, we will keep a portion of this income (this portion will depend on the amount of your annual rental income) for tax-filing preparation. If not collecting rent, the non-resident landlord will be obliged to cover their tax liability in full before Rentax files a tax return.

From 2024 onwards, Rentax will move to the new regime and will start remitting 20% of the gross rent to Revenue on behalf of the non-resident landlord. Rentax may collect either the full rent on behalf of the non-resident landlord or the 20% tax only.

Our fees

Registration

A once-off fee of €100 for registration as your Collection Agent

Monthly fee

A €30 monthly administration fee per property

Filing annual tax return

A fee of €338 to cover the preparation and filing of your annual tax return.

Non-resident landlord?

Request a call back for Irish Rent Collection Agent Service now!