Your Bullsh*t-Free Guide to Self-Assessment Taxes in Ireland

Did you know that there are over 300,000 self-employed people in Ireland? This accounts for approximately 14.5% of the country's workforce.

Unlike PAYE employees, if you are self-employed or if you earn income outside the PAYE system, you must file your own end-of-year tax return. Find out how to claim tax back in Ireland if it's your first time trying to get a tax refund.

Many people who earn income outside the PAYE system feel unsure of their tax obligations and entitlements.

If you don't earn any income from self-employment, you may find our PAYE tax guide useful.

But if you do earn money outside the PAYE system – such as from rental income, trading or investments etc – you'll no-doubt find this Bullsh*t-free guide to Self-Assessment taxes in Ireland to be a very useful resource.

Throughout the following chapters (you can browse these using the contents bar on the right) we'll cover everything you need to know from what your obligations are, to the reliefs & credits you are entitled to, and how you can go about getting them.

Plus we've broken all of the tax jargon down into plain English!

So, let's get started then! Here's the basics of Self-Assessment tax in Ireland.

Watch our FREE Self-Assessed Tax Webinar

Becoming self-employed

In Ireland, 14.75% of the workforce is self-employed. But what does this mean?

Well, when you become self-employed, you conduct your own business rather than work for an employer.

In truth, there are a number of advantages and disadvantages to working for yourself. For example, when you are self-employed you are in complete control of what you do, as well as where and when you want to do it. In other words, you organise your own business type, working hours and location.

On the other hand, many self-employed people work very long hours and do not have a regular source of income.

You will also have to handle your own tax affairs - through the self-assessment tax system. Through the following chapters, this no-nonsense guide will outline everything you need to know about tax for the self-employed.

Download your FREE Self-Assessed Irish Tax Guide

Self-employment and tax

You will be considered 'a chargeable person' for self-assessment purposes if you are due to pay tax on behalf of yourself (or another person) for a particular tax period.

For instance, if you:

- have other sources of income in addition to your PAYE salary

Or

- are self-employed

Or

- are a director of an Irish company

then you will be considered a 'chargeable person' (with some exceptions to this general rule).

You will not be considered a chargeable person if:

- Your total income consists of PAYE salary

- You are in receipt of both PAYE and non-PAYE income – where the total non-PAYE income assessable to tax

- Does not exceed €5,000 and

- Is coded into your certificate of tax credits (exception does not apply to company directors) or is taxed at source - You have been notified by Revenue that you don't need to file a tax return

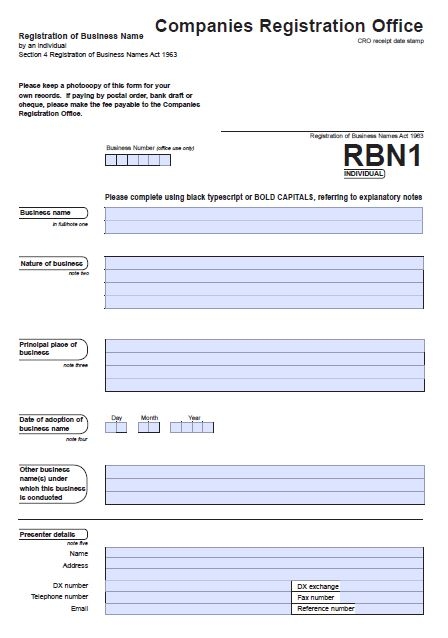

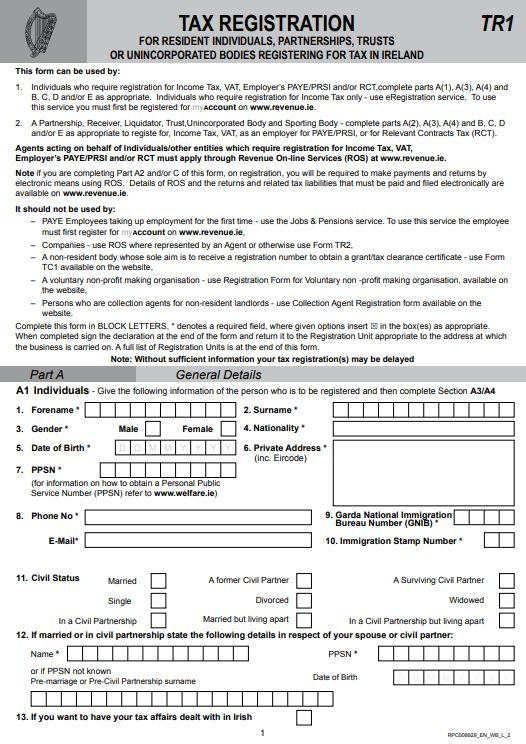

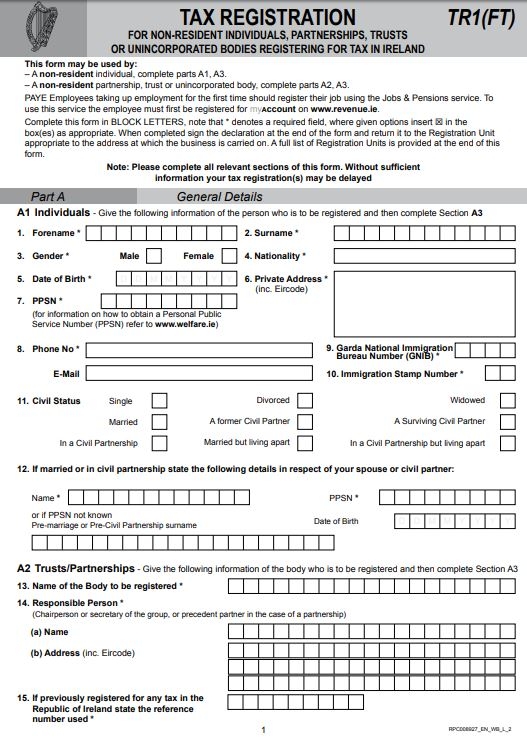

Once an individual becomes a chargeable person, they must register as such with Revenue by completing a Form TR1 or Form TR1 (FT).

A TR1 Form can be used by resident individuals, partnerships, trusts or unincorporated bodies registering for tax in Ireland.

Meanwhile, a TR1 (FT) Form can be used by non-resident individuals, partnerships, trusts or unincorporated bodies registering for tax in Ireland.

These forms can also be used to register for VAT, Relevant Contracts Tax and/or Employer's PAYE/PRSI.

Once completed, you will receive a 'Notice of Registration' confirming that your registration has been completed.

But when is tax actually due to be paid?

Many PAYE employees have their tax automatically deducted from their weekly or monthly salary payment.

However, the self-assessment system is very different to the PAYE system. In the self-assessment system, tax is due to be paid on or before 31 October each year following the year of assessment.

The tax that you pay is based on the income you earned during the previous tax year. So, for example, tax on income earned in 2023 is due on 31 October 2024.

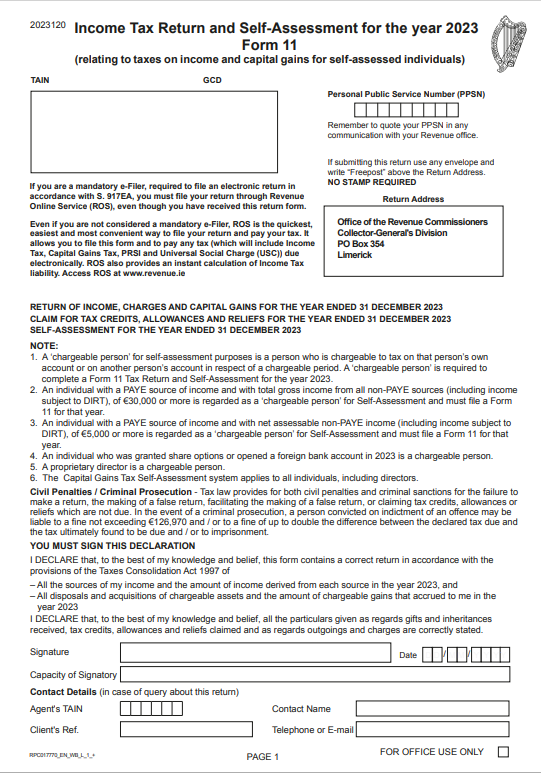

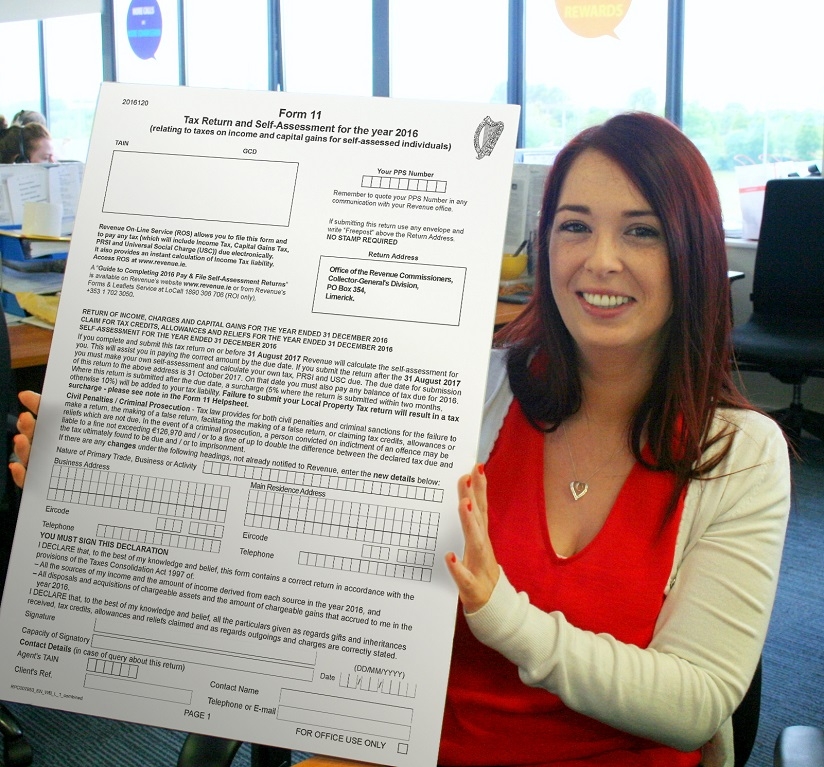

Many PAYE employees have never filed a tax return. However, every self-employed person must file a tax return every year. The type of tax return you have to file depends on how much income you earn.

If your taxable non-PAYE income in a year does not exceed €5,000 and your gross non-PAYE income does not exceed €30,000, you will need to submit a tax return Form 12. If your taxable non-PAYE income exceeds €5,000, or your gross non-PAYE income exceeds €30,000, you must register for self-assessment and file a tax return Form 11.

Note: An individual whose non-PAYE income is zero due, for example, to an allowance which reduces their taxable profits to zero, is considered a chargeable person. This is because zero profits can't be taxed through the PAYE system. In other words, a tax return Form 11 must be filed.

The deadline for filing a tax return (Form 11 or Form 12) for a tax year is the 31 October of the following year.

TR1 Form

Preliminary Tax

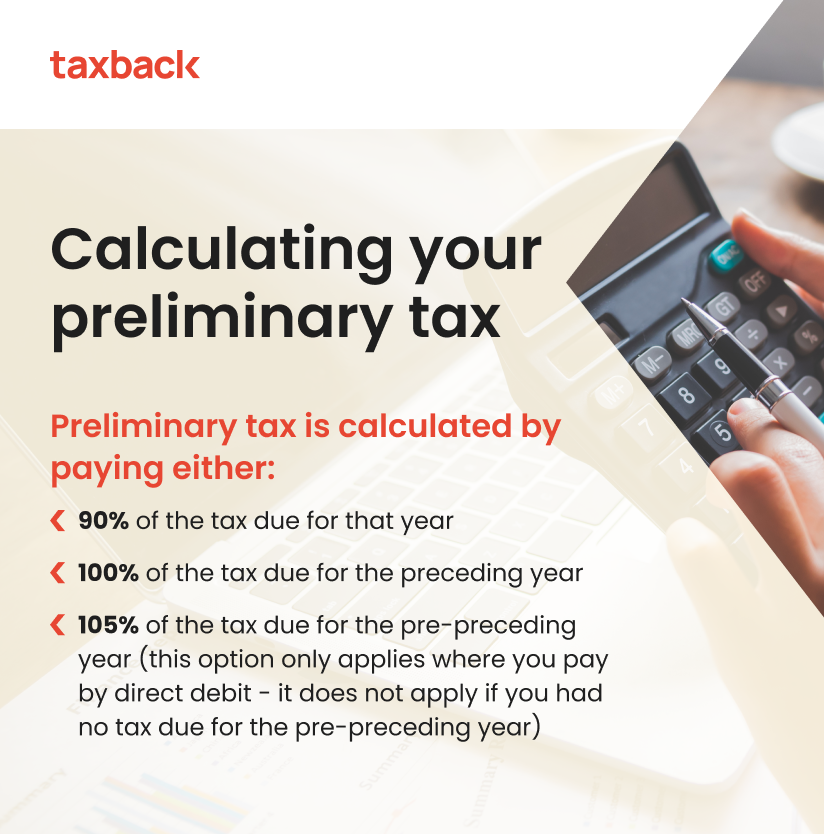

For Income Tax (IT) purposes, preliminary tax is your estimate of the IT, Pay Related Social Insurance (PRSI) and Universal Social Charge (USC) that you expect to pay for a tax year. You must pay this by 31 October of the tax year in question.

If you wish to pay preliminary tax, you must use a VISA or MasterCard credit or debit card

Preliminary tax is calculated by paying either:

- 90% of the tax due for that year

- 100% of the tax due for the preceding year

- 105% of the tax due for the pre-preceding year (this option only applies where you pay by direct debit - it does not apply if you had no tax due for the pre-preceding year)

For example – Margaret has a tax bill of:

- €2,000 in year one

- €3,000 in year two

- €4,000 in year three

When filing her tax return for year two (i.e. by 31 October of year three), she must choose the amount of preliminary tax she is going to pay in respect of year three.

She can choose either:

- €3,600 (90% of the tax due for that year, i.e. year three)

- €3,000 (100% of the tax due for the previous year, i.e. year two)

- €2,100 (105% of the tax due for the pre-preceding year, i.e. year one)

When Margaret is filing her tax return for year three (i.e. by 31 October of year four) she will calculate her tax bill for the year. If the preliminary tax she paid in year three is less than the amount of her tax bill, she will have to pay the balance. However, if it is more than this figure, she will be entitled to a tax rebate.

We take the hassle out of filing your Irish tax return

Universal Social Charge

USC is a tax you pay on your gross income. Everyone earning over €13,000 (2023) gross income is liable to pay USC. Payment of USC is due to Revenue when you are filing your tax return.

Standard Rates of USC 2024

| 2024 | Rate |

| First €12,012 | 0.5% |

| €12,012 - €25,760 |

2% |

| €25,760 - €70,044 |

4% |

| Balance | 8% |

There is a USC surcharge of 3% if your non-PAYE income is more than €100,000 a year.

Reduced rates of USC apply to some people who:

Are aged 70 or over or hold a full Medical Card (not a GP Visit Card).

The reduced rates apply for the whole year when you:

You are aged 70 or over and your total income is €60,000 or less.

If you hold a medical card, you should tell Revenue to ensure you are on the reduced rate.

If your income is more than €60,000, the standard rates of USC apply to your full income.

If you are self-employed, you pay your USC liability alongside your preliminary tax payment.

You do not have to pay USC on your social welfare payments or on any income you pay Deposit Interest Retention Tax (DIRT) on.

And depending on your age and situation you may be exempt from, or entitled to, reduced rates of USC.

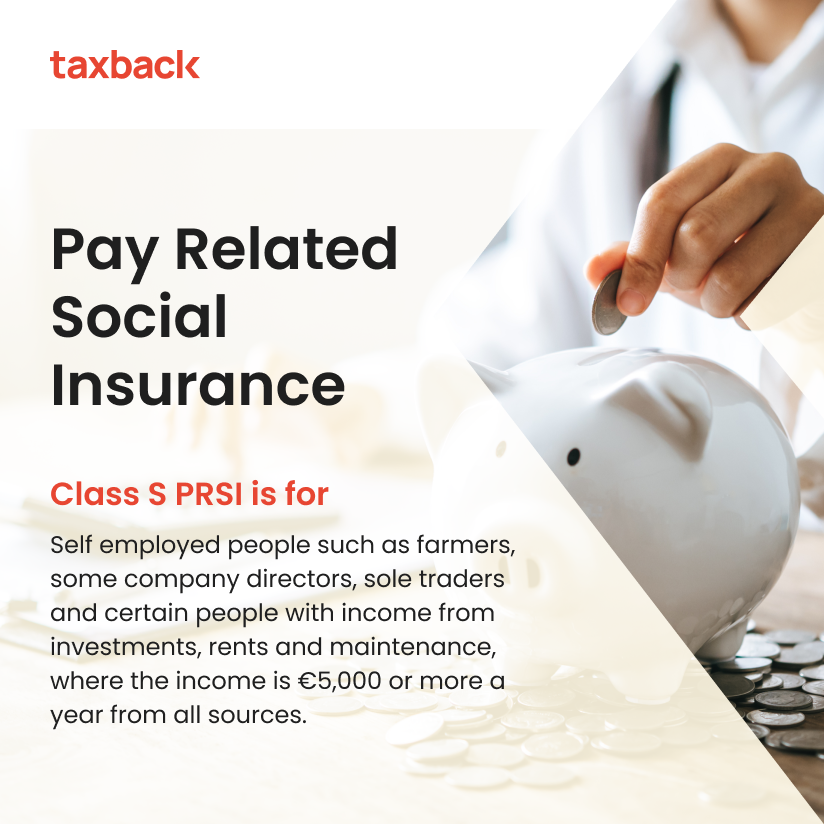

PRSI

Usually, if you are self-employed you will pay Class S PRSI. Class S PRSI contributions are paid at:

• a rate of 4% on all income

• or €500 - whichever is the greater

Note: if you earn less than €5,000 from self-employment in a year you are exempt from paying Class S PRSI but you may pay €500 as a voluntary contributor.

If you are an employee of a limited company that is owned by your spouse or a family member, you are insurable at PRSI Class A (or Class J). If you are not an employee but participate in the running of the company or if you hold a directorship or shareholding position and have control over its operations, you may be treated as a self-employed contributor and liable to pay Class S PRSI (provided you earn more than €5,000).

Two or more family members who operate a business as a partnership and share the profits are insurable as self-employed contributors at Class S (if they earn over €5,000). Family members employed by a partnership pay Class A (or Class J).

Tax credits

Tax credits can be used to reduce your overall tax bill. So it is definitely worth investigating which tax credits you are entitled to.

For starters, the Earned Income Tax Credit applies to most self-employed people. This tax credit is worth €1,875 for 2024 and you can subtract this figure from your tax liability.

The earned income credit cannot be transferred to your spouse or civil partner.

You may have income that qualifies for the Employee Tax Credit and the Earned Income Tax Credit. If so, the combined credits cannot exceed the maximum value of the Employee Tax Credit (€1,875).

The credit available is the lower of:

€€1,875

or

20% of your qualifying earned income.

Further detail on tax credits is available here.

We take the hassle out of filing your Irish tax return

Filing a return

It's possible to file a tax return (for example – Form 11 or Form 12) yourself through Revenue Online Service (ROS). Alternatively, if you would prefer not to complete your income tax return yourself, you can enlist the services of an expert tax agent such as Taxback and they can file your return for you.

Overpaying tax

Every year many people pay either too much or too little tax. An overpayment of tax could arise as a result of not claiming all of the credits and reliefs you are entitled to.

The good news is that you can go back 4 years to claim a refund and the deadline to file your tax return is 31 October each year. In other words, if you want to claim a tax refund from 2020, then 2024 is the last year that you can claim.

To get your tax rebate, you can contact Revenue directly. Alternatively, a tax agent such as Taxback can file your paperwork and get your tax refund for you.

Pay and file system - how does it work?

By 31 October in a tax year, you must:

- pay your preliminary tax for that year

- file your tax return and self-assessment for the previous tax year

- pay any balance of tax due for the previous year

Filing before the deadline is very important. If you miss these deadlines you will have to pay interest and fines on top of your tax bill.

You will have to pay a surcharge if you send your tax return after the deadline, as follows:

- within two months of the filing date: 5% of the tax due, up to €12,695

- over two months: 10% of your tax liability, up to €63,485

However, when you pay and file through the Revenue Online Service (ROS), the 31 October deadline is extended to mid-November.

Note: even if you pay and file on time for Income Tax, a 5% surcharge may apply if your Local Property Tax (LPT) obligations are not met.

A chargeable person is liable to interest if:

- the preliminary tax paid is insufficient or is not paid on time

- the balance of tax due is not paid on time

Interest runs from the due date for payment and the interest charge is 0.0219% per day or part of the day.

We take the hassle out of filing your Irish tax return

Should I register for self-assessed tax?

There are many reasons why you may need to register for self-assessment tax (by completing a TR1 form or TR1 (FT) form).

These include if you:

- are self-employed

- receive income from non-Pay As You Earn (PAYE) sources, for example:

- rental income

- investment income

- foreign income including foreign pensions

- maintenance payments

- fees that are exempt from PAYE

- have profited from share options or share incentives (this is only applicable for the years before 2024, however, employers must still report the profit via payroll)

- are a director of an Irish company

Although company directors are always chargeable persons, it is Revenue practice to exclude the following:

- Directors of dormant companies

- Directors of companies in which they own 15% or less of the share capital

We take the hassle out of filing your Irish tax return

In other words, even if you are an employee in the PAYE system you may need to pay tax through the self-assessment if you earn non-PAYE income.

You do not need to register for self-assessment if:

- you only have PAYE income

- your taxable non-PAYE income does not exceed €5,000 and is taken into account in calculating your tax credits and standard rate cut-off point for PAYE purposes. It may also be taxed at source, providing the gross non-PAYE income does not exceed €30,000 (in these cases you must submit a Form 12).

What do I pay tax on?

You must declare all non-PAYE income to Revenue for tax purposes. Even if there is no record of a particular transaction, it is still important that you declare the cash you received for your services.

So, for example, if you teach guitar in your spare time, you will need to declare any income you receive to Revenue.

Your tax obligations will differ depending on whether you have earned more or less than €5,000 in a year.

For example, Philip teaches guitar in his spare time. This earns him €250 every month (€3,000 per year). Meanwhile, Carl delivers food with Deliveroo at the weekend and earns €170 per week (€8,840 per year).

Carl has earned more than €5,000 a year and will need to register as a self-assessed individual with Revenue by completing a TR1 form (he only needs to do this once). Carl must then file a Form 11 tax return and make a tax payment by 31 October each year for the previous year's earnings.

Because Philip earns less than €5,000 a year, Form 12 is the correct option for him to file. Similarly to Form 11, Philip's earnings from the previous year will be relevant when completing a Form 12.

You don't have to pay tax on:

- Scholarship income

- Interest from Savings Certificates, Savings Bonds, and National Installment Savings Schemes with An Post

- Payments to approved pension schemes

Certain types of income are exempt from income tax. However, you may still need to pay USC and PRSI on this income. Examples of these exempt incomes include:

- Artists' Exemption

- Rent-a-Room Relief

- Woodlands

Trading and professional income

A self-employed person is someone who runs their own business - known as a trade or profession.

The full amount of profits or gains associated with the business is taxed in the year of assessment. 'The full amount of profits or gains' is taken to be the difference between the income from the trade and the expenditure incurred and allowed under tax law in earning that income.

When a trader makes a loss, it can be used in two ways:

- Use it to reduce the non-trading income for the year of loss,

or

- Carry it forward to future years and set it against future profits of the same trade

We take the hassle out of filing your Irish tax return

Universal Social Charge (USC)

On 1 January 2011, the Universal Social Charge (USC) replaced both the income levy and the health levy (also known as the health contribution).

If you earn more than €13,000 (gross) per year you will have to pay USC. The payment will be due when you complete your annual Form 11 tax return.

Standard rates and thresholds of USC for 2023

| 2023 | Rate |

| First €12,012 | 0.5% |

| From €12,012 - €22,920 | 2% |

| €22,921 - €70,044 | 4.5% |

| Balance | 8% |

Standard rates and thresholds of USC effective from 1 January 2024

| 2024 | Rate |

| First €12,012 | 0.5% |

| From €12,012 - €25,760 | 2% |

| €25,760 - €70,044 | 4% |

| Balance | 8% |

Bank Bonuses

A 45% rate applies to bonuses paid to employees of financial institutions that received financial support from the government including:

- Allied Irish Bank

- Anglo Irish Bank

- Bank of Ireland

- Educational Building Society

- Irish Nationwide Building Society

If the payments are €20,000 or less in a year, the standard rates of USC apply.

If the payments are more than €20,000 in a year, the full amount is at 45% USC.

Property relief surcharge

An additional 5% rate of USC applies to taxable income that is 'sheltered' by certain property or area-based incentive reliefs. This includes all of the property-based capital allowances and the relief for residential lessors known as 'section 23-type' relief.

The surcharge applies to:

Capital allowances made in or carried forward to the tax year 2012 and any later tax year

Any losses carried forward to 2012 or a later year that are due to section 23-type relief.

There is also a USC surcharge of 3% if your non-PAYE income is more than €100,000 a year. In other words, USC is charged at 11% on non-PAYE income that exceeds €100,000.

The property relief surcharge does not apply if your gross income is less than €100,000

In the case of an individual whose total income in the year does not exceed €60,000 and is either:

- Aged 70 or over,

or - holds a full medical card

In this case a 2.5% rate applies to all income over €12,012.

Many types of income are exempt from USC including:

- Where an individual's total income does not exceed €13,000

- All Department of Social Protection payments

- Income subjected to DIRT, Credit Union dividends

- Tax exempt portion of termination payments

- Certain withdraws of Additional Voluntary Contributions (AVC) before retirement

We take the hassle out of filing your Irish tax return

PRSI

Pay Related Social Insurance (PRSI) contributions are deducted from your income and used to fund certain social insurance payments, such as state pensions. There are different rates of PRSI for different categories – for example most PAYE employees pay Class A PRSI.

Self-employed people (aged between 16 and 66) usually pay Class S PRSI at 4% on all gross income (less allowable expenses) for tax purposes. You must pay 4% of all your income, or €500, whichever is greater.

Note: If you earn less than €5,000 from self-employment in a year you are exempt from PRSI, but you may pay €500 as a voluntary contributor (if you meet certain conditions).

The vast majority of self-employed people pay their tax to Revenue through the self-assessment system. However, certain categories of self-employment will pay their PRSI through the PAYE system or directly to the Department of Social Protection.

Who is self-employed?

Under PRSI Class S self-employed people are defined as:

- professional people (for example doctors, dentists, solicitors etc.)

- sole traders, people in business on their own or in partnership, farmers, religious, contractors, sub-contractors

- people with income from investments, rents or maintenance payments

- employees who are also self-employed in a trade or profession

- company directors, and others, who pay their tax through the PAYE system but who are not regarded as employees for social insurance purposes

- certain artists and childminders who have been made exempt from income tax by Revenue

- spouses or civil partners of self-employed contributors who participates in the business

Income excluded from PRSI

There are some types of income that do not have to be taken into account when you are working out what your PRSI contribution should be:

- capital allowances

- benefit income such as pensions, allowance or supplement from the Department of Social Protection

- occupational pensions

- allowances paid by the Health Service Executive

- income continuance payments that have been approved by Revenue and are received by a person forced to leave employment due to illness

- redundancy payments and early retirement bonus

- retirement lump sums in excess of €200,000 which are subject to income tax

- the early encashment of certain amounts of private pensions which are subject to income tax by individuals in the public sector who had previously been self-employed

We take the hassle out of filing your Irish tax return

Persons excluded from PRSI

Certain people can also be excluded from paying Class S PRSI including:

- Relatives of the self-employed (other than spouses or civil partners) who help out in the running of the business, but who are not business partners

- Those in receipt of Pre-Retirement Allowance on an ongoing basis

- People with annual income of less than €5,000

- People who are not ordinarily resident in the State with solely unearned income

- People who pay contributions at Class A and whose only self-employment income is unearned income

- People in receipt of Occupational pension whose only self-employment income is unearned income

Social Welfare

When you make a PRSI contribution (in any Class), it is recorded to determine your future entitlements to social welfare benefits.

If you are self-employed and you pay Class S PRSI contributions, you will be covered for a limited number of payments. In general, under Class S you will not be covered for any short-term payments including illness and disability payments. It also does not cover you for Jobseeker's Benefit.

However, Class S contributions can entitle you to:

- Maternity and Paternity Benefit

- Adoptive Benefit

- Widow's, Widower's or Surviving Civil Partner's (Contributory) Pension

- Guardian's payment (Contributory)

- State Pension (Contributory)

- Treatment Benefit, (Dental, Optical and Aural)

Note: You can't claim your State Pension (Contributory) until all necessary payments have been made. If you are aged over 66 and you still owe Class S PRSI contributions, your State Pension (Contributory) will only be paid from the date that you have paid all outstanding contributions and any outstanding income taxes in full.

We take the hassle out of filing your Irish tax return

Voluntary contributions

Self-employed people who are not liable to pay PRSI may be eligible to become a voluntary contributor, subject to meeting certain conditions.

Voluntary contributions allow you to remain insured once you leave the compulsory PRSI system. You may choose to pay voluntary contributions, provided you meet certain conditions including if you:

- are no longer covered by a PRSI scheme on a compulsory basis in Ireland

- are no longer covered by a PRSI scheme on a compulsory or voluntary basis in any other E.U. country

- are under age 66

- satisfy the scheme's qualifying conditions

PRSI for share fishermen

A share fisherman (or woman) (who is classed as self-employed), may choose to pay an additional PRSI contribution at Class P. This contribution provides cover beyond normal Class S PRSI benefits including:

- Limited Jobseeker's Benefit (up to 13 weeks in each calendar year)

- Limited Illness Benefit (up to 52 weeks)

- Treatment Benefit, for their dependent spouse/civil partner

The rate of Class P contribution is 4% of income, subject to the income ceiling applied to self-employed contributors. This contribution is additional to the normal Class S payment made by the contributor. In order to remain a Class P contributor a person must continue to be liable for Class S PRSI and ensure that all payments due are up-to-date.

PRSI Refunds

A refund of PRSI is payable to a self-employed contributor who has reached the age of 56 years on or before 6 April 1988, paid PRSI for the first time on or after that date and does not qualify for either a State Pension (contributory) or State Pension (non-contributory). The refund payable is 53% of PRSI paid, which is the pension element of Class S PRSI contributions.

We take the hassle out of filing your Irish tax return

Capital Gains Tax

If you invest your money in an asset (like stocks or shares) and you subsequently dispose of the asset you may have to pay Capital Gains Tax (CGT).

CGT is a tax charged on the capital gain (profit) made on the disposal of an asset (the tax is payable by the person making the disposal). The gain/profit (the difference between the price you paid for the asset and the price you sold it for with allowable deductions subtracted) is considered taxable income.

Rates

The standard rate of CGT is 33% for disposals made on or after 5 December 2012.

However, a rate of 40% can apply to the disposal of certain foreign life assurance policies and units in offshore funds. Gains from venture capital funds are charged at 12.5% (individuals and partnerships) or 15% (companies). And, for certain windfall gains (attributable to relevant planning decisions on disposals made between 30 October 2009 and 31 December 2014) the rate of tax is 15%.

A reduced CGT rate of 10% will apply to the disposal in whole or in part of a business up to an overall limit of €1 million in qualifying chargeable gains. Payments under the new raised bog restoration incentive scheme to relevant owners and rights holders will be exempt from CGT.

What is an asset?

Some common types of investment assets are stocks, shares, currency and property. But an asset is not just something you own outright. It can also be something you have an interest in, for example, a leasehold interest in land.

What is a disposal?

Disposal refers to the transfer of ownership of an asset by way of:

- Sale

- Exchange

- Gifting

- Settlement on trustees

What do you pay CGT on?

You have to pay CGT on gains made from the sale, gift or exchange of an asset such as:

- land

- buildings (houses, apartments, or commercial property)

- shares in companies (Irish-resident or non-resident)

- assets that have no physical form such as goodwill, patents and copyright

- currency (other than Irish currency – including cryptocurrency)

- assets of a trade

- foreign life insurance policies and offshore funds

- capital payments (in certain situations).

You may also have to pay CGT on gains for other types of assets. Examples of these assets include antiques, paintings and jewellery.

In some situations, reliefs and exemptions may apply.

You may have made a loss when disposing of an asset. You can use this loss against a capital gain made by you in the year that you made the loss. You can also carry it forward until you can offset it against a capital gain. However, you can't backdate the loss in order to offset it against chargeable gains which were made in earlier years of assessment. Capital losses are also not available for offset against income taxable under corporation tax or income tax.

In relation to married couples and civil partners, surplus losses of one spouse or civil partner in a year of assessment can be transferred to the other spouse or civil partner for offset against chargeable gains arising in the same year of assessment.

We take the hassle out of filing your Irish tax return

Disposal of a Business or Farm

If you are disposing of a business or a farm to someone other than your child and you are 55 or older, you may be eligible to claim CGT relief when you dispose of any part of your business or farming assets. This is referred to as retirement relief but you do not have to retire in order to qualify.

There are certain circumstances in which you may qualify for this relief before you are 55. They are as follows:

- You are unable to continue farming due to ill health.

- You reach the age of 55 within 12 months of the disposal.

- For disposals made up to and including 31 December 2013, you're eligible to claim full relief when the market value at the time of disposal does not exceed €750,000.

- This threshold may be reduced to €500,000 if both of the following are applicable;

- The disposal takes place on or after 1 January 2014

AND

You are 66 or older.

If the market value is more than the above defined threshold, marginal relief may apply. This will limit the CGT to half the difference between the market value and the threshold.

The €750,000 (€500,000 after 1 January 2014 for those aged 66 or older) is a lifetime limit. If you exceed this threshold, relief given on earlier disposals will be withdrawn.

Disposing of a farm to your child

You can dispose of all or part of your business or farming assets to your child. If you do, you may be entitled to relief from CGT.

- The definition of your child for the purpose of this relief is as follows:

- A child of your deceased child.

- Your niece or nephew who has worked full time in the business or farm for a minimum of 5 years.

- Your foster child who you have maintained for a minimum of 5 years.

The amount of relief you're entitled to depends on your age at the time of the disposal:

- Up to 31 December 2013, you can claim full relief if you're 55 or older

- From 1 January 2014, you can claim full relief if you are between 55 and 65. If you're older the relief is restricted to €3 million

If your child disposes of the asset within 6 years, the relief will be withdrawn. Your child must pay CGT on the original disposal by you, in addition to CGT on their own disposal.

CGT Reliefs

Indexation Relief

Indexation Relief (also known as 'inflation relief) may be claimed if you owned the asset you're selling before 2003.

When it comes to Indexation Relief, the market value of the asset at the time you became the owner is increased. This increase is based on inflation, calculated by the Central Statistics Office.

Example

Sean bought his investment property in June 1990 for €50,000. He incurred costs of €2,000 on the purchase of the property. In 2017, he sold the house.

The purchase price and the costs (€52,000) are indexed by the relevant indexations factor (totalling €74,984). This sum is then deducted from the sale price of the property in calculating the amount of CGT due.

In the case of land that is being used for development, relief only applies to a specific value. This is the value that the land would have had at the date you became the owner if it was not development land.

Indexation relief was abolished for the tax year 2003 and all subsequent years. if you became the owner of an asset in 2003, or in later years, you're not entitled to indexation relief on that asset.

Farm Reconstructing Relief

You may claim a relief from CGT if you dispose of farm land in order to make your farm more efficient. The conditions are;

- The first sale or purchase must have occurred between 1 January 2013 and 31 December 2019.

- The next sale or purchase must occur within 24 months of the first sale or purchase. You can also claim the relief where you exchanged land with another person.

You must receive a certificate from Teagasc in order to claim this relief. The certificate must state that you carried out the transaction for farm restructuring purposes.

The land you sold or exchanged may have a higher value than either:

- The land you purchased.

- The land you received in exchange for your land.

In this case, the amount of relief you can claim will be reduced.

You may dispose of the land you purchased or exchanged within 5 years of the date of purchase or exchange. If you do, you won't be able to claim Farm Restructuring Relief. Unless you sell the land under a compulsory purchase order.

Revised Entrepreneur Relief

You can claim relief from CGT if you've made gains from disposing of business assets. There is a lifetime limit of €1 million on the gains that you can claim relief on. The gains on disposals must be made on or after 1 January 2016.

If you claim this relief, you have to pay CGT at the rate of 10% on gains from the disposal of business assets. This is reduced from the normal rate of 33%. Up to 31 December 2016, gains from this kind of disposal are charged at 20%.

Compensation and insurance money

Sarah received an insurance policy payment for damage caused by a fire in a property that she owns. This is treated as capital payment derived from an asset (the property) which means she must pay CGT on it.

On the other hand, if Sarah decides to use the payment to repair the damage done to the property, she has the option of deferring the payment of the CGT. The amount of compensation she receives will be treated as reducing the cost of the asset. The CGT won't be due on the payment until the asset is sold.

The deferral of CGT is a relief meaning it must be claimed, it does not apply automatically.

Land or buildings acquired between 7 December 2011 and 31 December 2014

You may be due relief if you disposed of land or buildings acquired between 7 December 2011 and 31 December 2014. You must have owned the land or buildings for at least 7 continuous years. You can reduce the gain by the number of years that you owned the property, divided by 7 years.

If you owned buildings or land for 10 years, the gain will be reduced by seven tenths (7 years/10 years)

You may claim the relief in respect of land or buildings in this country or in any European Economic Area (EEA state).

You'll get full relief on any gain made by you, so long as the disposal is on or after 1 January 2018, providing you owned the land or building for at least 4 years and up to 7 years.

We take the hassle out of filing your Irish tax return

CGT Clearance Certificate (CG50A)

You require a CG50A certificate if:

You sell an asset on or after 25 March 2002 for over €500,000.

You sell a house or apartment on or after 1 January 2016 for over €1 million.

Exemptions from Capital Gains Tax

If you only like to dabble in investments, the good news is that the first €1,270 of taxable gains in a tax year are exempt from CGT. If you are married or in a civil partnership this exemption is available to each spouse or civil partner but is not transferable.

Profits made on the disposal of some assets are exempt from CGT.

Examples include:

- profit on the disposal of property owned by you (house or apartment) which you or a dependent relative occupied as a sole or main residence (this is known as principal private residence relief)

- betting, lotteries, sweepstakes, bonuses payable under the National Instalments Savings Scheme and Prize Bond winnings are all exempt from CGT

- transfers of assets between spouses and civil partners. Transfers of assets between spouses and civil partners who are separated are also exempt if they are made under a Separation Agreement or a court order

- the transfer of a site from parent to child for the purposes of constructing the child's own private residence, where the site's market value does not exceed €500,000, is also exempt from CGT

- no CGT is due on assets transferred at death. When the person who acquired the assets comes to dispose of them they are treated as if they had been acquired at their market value on the date of the death

- profit on Government Loans and Debenture issued by certain semi-state bodies

- profit on disposal of wasting chattels (movable goods) for example, animals and private motor cars

- life assurance policies (unless purchased from another person or taken out with certain foreign insurers on or after 20 May 1993)

- profits made by individuals on tangible moveable property worth €2,540 or less at the time of disposal

Download your FREE Self-Assessed Irish Tax Guide

When is CGT due?

For CGT purposes, the tax year is divided into two parts.

- Part 1 ('initial period') - 1 January to 30 November

- Part 2 ('later period') - 1 December to 31 December

For disposals in the initial period CGT payments are due by 15 December in the same tax year. CGT for disposals in the later period are due by 31 January in the following tax year.

For example, if George disposes of his shares in June 2023, he must pay the CGT due to Revenue by 15 December 2023. Had George held on to his shares and disposed of them in December 2023, his CGT would have been due on 31 January 2024.

If you do not pay the CGT liability by the due date or if the tax payment is less than the required amount, interest may be charged on the outstanding amount.

Filing of Capital Gains Tax return

You must file a return on or before 31 October in the year following the tax year in which you disposed of the asset. There are a number of different CGT return forms:

- CG1 Form – if you do not usually submit annual tax returns

- Form 12 – if you are a PAYE worker

- Form 11 – if you are regarded as a 'chargeable person'

Note: Even if you've made a loss on your investment, you're obliged to file a tax return.

Though you may file your return the following year, you must pay the CGT in the same year as the disposal of the asset, unless you dispose of the asset in the 'later period' (as above).

Where a CGT return is filed after the required deadline, a surcharge will be imposed by Revenue:

- Where a late return is filed within two months of the due date, a surcharge of 5% of the tax payable/paid, or €12,695, if lower, is applied.

- Where the return is filed more than two months late, the surcharge is 10% of the tax payable/paid, or €63,485, if lower.

We take the hassle out of filing your Irish tax return

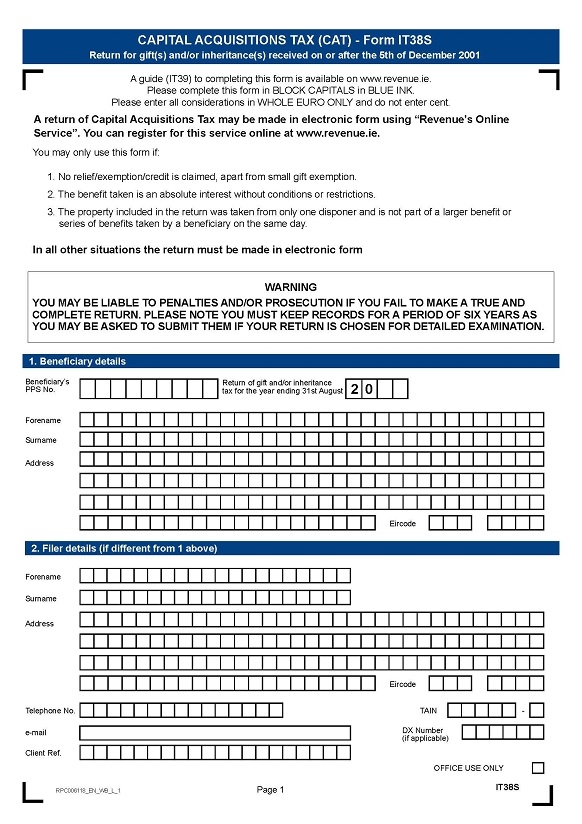

Capital Acquisitions Tax (CAT)

If you receive a gift or inheritance, you may need to pay a 'gift tax' on it called Capital Acquisitions Tax. You may receive gifts and inheritances up to a set value over your lifetime before having to pay CAT. Once due, it is charged at the current rate of 33% (valid from 6 December 2012).

When do I need to pay CAT?

You'll pay CAT if a gift is valued over a certain limit and various thresholds apply. The thresholds are dependent on the relationship between you (the beneficiary) and the gift giver (the disponer).

Exemptions and reliefs

There are also a number of exemptions and reliefs depending on the type of gift or inheritance. For example, if you receive a gift or inheritance from your spouse/civil partner, then you're exempt from Capital Acquisitions Tax.

Also, the tax applies to property in Ireland even if the property isn't in Ireland when either the person giving the benefit or the person receiving it are resident or ordinarily resident in Ireland for tax purposes.

A number of different thresholds apply for gifts/inheritance on or after 12 October 2016.

Capital Acquisitions Tax Thresholds

Group A: €335,000

Applies when the person receiving the benefit is a child of the person giving it. This includes a stepchild or adopted child.

Group B: €32,500

Applies where the beneficiary is a brother, sister, niece, nephew or lineal ancestor or lineal descendant of the disponer.

Group C: €16,250

All other cases

Group A

Applies if the person receiving the benefit is a child of the person giving it.

This includes a stepchild or adopted child. It can also include a foster child if the child resides with you and was under your care at your own expense for a period or periods totaling at least 5 years before the foster child became 18.

This minimum period doesn't apply in the case of an inheritance taken on the date of death of the gift giver or disponer. In this case the Group A threshold will apply provided that the foster child was placed in the care of the disponer prior to that date.

Group A also applies to parents who take an inheritance from their child but only where the parent takes full and complete ownership of the inheritance. If a parent doesn't have full and complete ownership of the benefit, or if a parent receives a gift, Group B will apply.

Group B

Applies where the beneficiary is a:

- Parent (however if a parent inherits from their child with full and complete ownership of the inheritance then it's exempt from tax if in the previous 5 years, the child took an inheritance or gift from either parent that wasn't exempt from Capital Acquisitions Tax. In this case, no tax needs to be paid even if the inheritance from the child is over the threshold).

- Grandparent, grandchild or great-grandchild (If a grandchild is a minor (under 18 years of age) and takes a gift or inheritance from his or her grandparent Group A may apply if the grandchild's parent is deceased).

- Brother or sister, and nephew or niece of the giver (Group A may apply if the nephew or niece has worked in the business of the person giving the benefit for the previous 5 years and meets the following criteria:

- The nephew or niece is a blood relation rather than a nephew or niece-in-law

- The gift or inheritance consists of property used in connection with the business, including farming, or of shares in the company

- If the gift or inheritance consists of property then the nephew or niece must work more than 24 hours a week for the disponer at a place where the business is carried on, or for the company if the gift or inheritance is shared. However if business is carried on exclusively by the disponer, their spouse and the nephew or niece then the requirement is that the nephew or niece work more than 15 hours a week.

The relief doesn't apply if the benefit is taken under a discretionary trust.

Group C

Applies to any relationship not included in Group A or Group B.

If you receive a benefit from a relation of your deceased spouse or civil partner, you can be assessed in the same group as your spouse or civil partner would have been if they were receiving a benefit from their relation.

For example, if you get a benefit from the father of your spouse/civil partner, the group threshold would be Group C.

However, if you receive a benefit from the father of your spouse/civil partner and your spouse/civil partner is deceased, then the group threshold would be the same as for a child receiving a benefit from a parent (Group A).

Valuation

The valuation is the day that the market value of the property comprising the gift/inheritance is established. In the case of a gift, the valuation date is normally the date of the gift.

If it's an inheritance, the valuation date is normally the earliest of the following dates:

- Date the inheritance can be set aside for or given to the beneficiary

- Date it's actually retained for the benefit of the beneficiary

- Date it's transferred or paid over to the beneficiary

The valuation date is typically the date of death in the following circumstances:

- Gift made in contemplation of death

- Where a power of revocation hasn't been exercised - This could happen if a person makes a gift of property but reserves the power to take back the gift. If he or she dies and this power ceases, the recipient then becomes taxable as inheriting the benefit.

If the beneficiary had free use of the benefit before this, he or she will be taxed as receiving a gift of the value of the use of the property.

Taxable value

A gift acquires its market value at the time you become entitled to it. The value that's taxable is then the market value after following deductions:

- Any liabilities

- Costs and expenses that are properly payable

- Including debts due to the inheritance or gift-for example, funeral expenses, costs of administering the estate or debts owed by the deceased

- Stamp duty, legal costs

If you make a payment for the benefit or some other contribution in return for it, this may be deducted and is known as a 'consideration' and could be a part payment or payment of debts of the donor.

If you don't get full ownership but instead receive a benefit for a limited period, then a number of factors are taken into account to calculate the value.

Rates

Capital Acquisitions Tax is charged at 33% on gifts or inheritances made on or after 6 December 2012 (the rate was formerly 30%).

This only applies to amounts of capital gain over the group threshold.

Exemptions from CAT include:

- Gifts/inheritances from a spouse/civil partner

- Payments or compensation for damages

- Benefits used only for the medical expenses of permanently incapacitated person

- Benefits taken for charitable purposes or received from a charity

- Lottery, sweepstake, game, or betting winnings

- Retirement benefits, pension, and redundancy payments are usually not liable

The first €3,000 of the total value of all gifts received from one person in any calendar year is exempt. This doesn't apply to inheritances.

If you receive a gift or inherit a house that was your main residence, it may be exempt from tax if you don't own or have an interest in another house, however there are conditions on how long you should be resident before and after receiving the benefit.

If a parent receives an inheritance from his/her child and takes complete ownership of the inheritance, it's usually taxable under Group A. However it's exempt if in the previous 5 years, the child took an inheritance or gift from either parent and it was not exempt from Capital Acquisitions Tax.

Other exemptions relate to certain Irish Government securities, bankruptcy, heritage property, and support of a child or spouse.

Note: CAT cannot be declared on Form 11 or Form 12. If you are liable to declare gifts or inheritance for CAT, you must do so on a Form IT38.

We take the hassle out of filing your Irish tax return

Rental income

If you earn money from renting out a property, or from another source that qualifies as rental income, it is taxable. Property includes residential property and commercial property – for example offices, shops, houses, factory land and more. Rental income also includes the receipt of premiums for the granting of a lease.

The total amount of rental income earned in a tax year is liable to tax. And if the rental income is earned from 1 January 2023 to 31 December 2023 but not received until 1 January 2024, it is still taxed in the 2023 tax year.

Rental income includes:

- the renting out of a house, flat, apartment, office or farmland

- payments you receive for allowing advertising signs or communication transmitters to be put up on your property

- payments you receive for allowing a right of way through your property

- payments you receive for allowing sporting rights such as fishing or shooting rights on your property

- payments you receive from your tenant to cover the cost of work to your rental property. Your tenant must not be required to pay for this work per the lease

- certain lease premiums, as well as deemed and reverse premiums

- conacre (a system of letting land, formerly in small patches or strips, and usually for tillage (growth of corn or potatoes)) lettings

- service charges for services connected to the occupation of the property

- payments from insurance policies that cover against the non-payment of rent

- if you are receiving rental income from a foreign property. See the foreign rental income section for more information

You must declare your rental income on your annual tax return. If your net rental income is less than €5,000 (and your gross rental income is less than €30,000), you can declare it through your Form 12. If your net rental income is over €5,000 (or your gross rental income is over €30,000) you declare your rental income in a Form 11.

If you are a non-resident landlord and your tenant pays rent directly to you, they are obliged to deduct tax from the rent at the standard rate (20%) and account for this to Revenue.

You are entitled to a credit for the tax deducted by your tenant. You must submit a Form R185 with your tax return to claim this. You may choose to use the services of a tax collection agent (who collects the rent and files your income tax on your behalf). If your tenant pays rent to an Irish based estate agent acting on your behalf, the tenant is not obliged or entitled to deduct income tax. The Irish agent is also not entitled to deduct tax from the rent on payment to the landlord but can retain a sufficient portion of the rents to satisfy the tax payable on the rents. The agent should not issue a Form R185 to the landlord.

Rental Residential Relief

In Budget 2024 the government announced a new tax relief for landlords against rental income earned from residential property for the tax years 2024 to 2027 inclusive.

This relief is only available to individual landlords for tenancies registered with the Residential Tenancies Board or for lettings of a residential property to a public authority.

The relief will reduce the tax due on residential rental income by up to:

- €600 in 2024

- €800 in 2025

- €1,000 in 2026 and 2027

If you make a rental loss

When your rental expenses are greater than your rental income, this is referred to as making a rental loss. You are entitled to carry forward your rental losses until you can offset them against a rental profit. However, you can only offset the loss against Irish rental income. You must use capital allowances first before offsetting the rental losses you brought forward from an earlier year.

You can't offset rental losses made by your spouse or civil partner against your own rental profits.

You also can't offset rental losses against other income or carry them back to a previous year.

We take the hassle out of filing your Irish tax return

Rent-a-room relief

If you rent out a room or rooms in your sole or main residence as residential accommodation you may qualify for rent-a-room relief. This will mean that the rental income you earn will be exempt from income tax.

To be eligible you must:

- Only claim relief on income earned from occupants who use the room on a long term basis

- Not claim relief on income earned from short-term guest arrangements

(If you normally rent out the room for the academic year and you rent it out for short breaks during the summer as well, you will need to separate this income and only declare the eligible income to Revenue for rent-a-room relief)

- Not earn more than €14,000 in rental income in the tax year

- Not deduct expenses from your rental income while claiming rent-a-room relief (it may be worth your while to opt out of the relief in a particular year in order to offset expenses against the rental income and avail of wear and tear allowances)

For example, Frank rents out a room in his home to Steve for two college semesters during the tax year. He earns €1,000 per month (excluding the summer months of June, July & August) in rental income – a total of €9,000. This income qualifies for rent-a-room relief and Frank will not have to pay income tax on the earnings.

During the summer months, Frank also rents out the room to tourists to earn some additional income. He earns €2,000 from these lettings. As this money was earned from short-term rentals, it does not qualify for rent-a-room relief and income tax will be due.

Further details on rent-a-room relief are available in Chapter 4.

Foreign rental income

Foreign rental income is considered to be income earned from rent of property (commercial or residential) aboard.

Your domicile (generally the country that is your permanent home) will likely affect how your foreign-sourced income is taxed in Ireland. A person who is resident and domiciled in Ireland must pay tax in Ireland on their worldwide income.

Someone who is not domiciled in Ireland only pays Irish tax on the foreign rental income that they bring into Ireland. This is known as the 'remittance basis' (for funds you send to Ireland from abroad via wire, mail, or online transfer) of taxation. On the remittance basis, you are taxed on the full amount of rental income that you remit and no deductions are eligible against the amount.

More information on the taxation of foreign rental income can be found here.

We take the hassle out of filing your Irish tax return

Blogging

If you operate a blog, and earn income (including payments for sponsored content and banner adverts etc.) from it, you will need to declare this money for tax purposes.

The correct tax return to file depends on your level of income.

If your net taxable income is less than €5,000 and your gross non-PAYE income is less than €30,000 in any given year, you must file a Form 12. Meanwhile, if your net taxable income is over €5,000 in total or your gross non-PAYE income is over €30,000 then you'll need to register as a sole trader using a TR1 Form. As well as completing a TR1 form you must file a Form 11 each year and state your income earned and pay the due tax.

You can find more information on tax on blogging income tax here.

The Sharing Economy

If you earn money through the sharing economy – for example by renting out a spare room on Airbnb or delivering food with Deliveroo - you will need to declare this revenue for tax even if it is not your main source of income.

Your tax obligations will differ depending on whether you have earned more or less than €5,000 in a year.

If your taxable income is more than €5,000 or your gross non-PAYE income is over €30,000 a year you will need to register as a self-assessed individual with Revenue by completing a TR1 form (you will only need to do this once). You'll then need to file a Form 11 tax return and make a tax payment by 31 October each year for the previous year's earnings.

If your taxable income is less than €5,000 a year and your gross non-PAYE income is less than €30,000, Form 12 is the correct option to file. Similarly to Form 11, your earnings from the previous year will be relevant when completing a Form 12.

Find out more about tax on income earned through the sharing economy.

If you have income from providing accommodation to occasional visitors for short periods. For example - you may provide the accommodation through an online accommodation booking site.

This income is not considered rental income. This is because the visitors use the accommodation as guests, rather than as tenants. Income from providing short term guest accommodation is taxable as either other income where the income is occasional in nature or as trading income where you are trading as an ongoing business, such as a bed and breakfast or a guesthouse.

Again, you must declare this income to Revenue under the appropriate category using either Form 12 or Form 11.

Have you earned income through Airbnb?

File your tax return the easy way

Cryptocurrency & Investments

Simply put, a cryptocurrency is an online currency. An investment in cryptocurrency is looked upon by Revenue in the same manner that an investment in any other currency, stock or share would be. If you are making a profit through the disposal (selling, gifting or exchanging your asset) of your cryptocurrency, you will need to declare it to Revenue for Capital Gains Tax (CGT).

Fortunately, the first €1,270 of your cumulative annual gains (after deducting expenses and losses from other cryptocurrency investments – further details below) is exempt from tax. But, any profit that you make above this figure will be taxed at 33% and you will need to file a tax return each year.

If you are self-employed, you can include your CGT liability on your Form 11. If you make a disposal between 1 January and 30 November you must pay CGT by 15 December of the same year. And, if you make a disposal between 1 – 31 December, you will have to pay your CGT by 31 January of the following year.

Every single gain you make from a cryptocurrency disposal must be declared to Revenue.

More information on tax obligations relating to investments in cryptocurrency can be found here.

Many cryptocurrencies, such as Bitcoin, are traded on a number of exchanges. Unlike shares or commodities the value of the cryptocurrencies may vary between exchanges. Therefore, here isn't always a single “exchange rate” for cryptocurrencies. A reasonable effort should be made to use an appropriate evaluation for the transaction in question.

The direct taxes are corporation tax, income tax and capital gains tax

The profits and losses of a non-incorporated business on cryptocurrency transactions must be reflected in their accounts and will be taxable on normal IT rules.

The profits and losses of a company entering into transactions involving cryptocurrency would be reflected in accounts and taxable under normal CT rules.

If a profit or loss on a currency contract is not within trading profits, it would normally be taxable as a chargeable gain or allowable as a loss for CT or CGT purposes. Gains and losses incurred on cryptocurrencies are chargeable or allowable for CGT if they accrue to an individual or, for CT on chargeable gains if they accrue to a company PAYE treatment of cryptocurrencies.

Where emoluments payable to an employee are paid in a cryptocurrency, the value of the emoluments for the purposes of calculating payroll taxes is the Euro amount attached to the cryptocurrency at the time the payment is made to the employee.

Returns to Revenue must be shown in Euro amounts and remittances made appropriately.

Deposit Interest Retention Tax

If you are an Irish resident and you make an investment in a deposit account (with any Irish bank, building society, post office or credit union), the interest that is paid on your investment is taxed at source.

The tax deducted by the bank is referred to as Deposit Interest Retention Tax (DIRT). The current rate is 33%.

The DIRT withheld by the bank satisfies the full requirement to pay income tax. Deposit interest is not liable to USC, although it may be liable to PRSI.

If you or your spouse/civil partner are 65 or if you're permanently incapacitated, you may not be liable for DIRT if you're exempt from income tax.

If you're exempt from DIRT, you should contact your financial institution to ensure your interest is paid without a DIRT deduction.

You must include the gross deposit interest you received in your tax return. A credit for DIRT withheld will then be allowed against your income tax liability.

DIRT is not charged on interest from the accounts of:

- individuals who are not resident in Ireland and who do not pay tax in Ireland. Although, a joint account owned by an Irish resident and a foreign resident is subject to DIRT

- companies that pay Corporation Tax

- Revenue-approved pension schemes

- charities

Interest from accounts in other European Union (EU) Member States and from non-EU countries

If you receive interest from an account in another EU Member State, you must pay the current rate of DIRT on the interest income. You must include the details of this on your annual tax return. The income will be subject to a higher rate of 40% tax if it is not returned on time.

Deposit interest from non-EU countries will be taxed at the current DIRT rate if you are a standard rate taxpayer and have made a timely return. However, a rate of 40% will apply if you are a higher rate taxpayer or if you have not made a return of this income on time.

We take the hassle out of filing your Irish tax return

First-time buyers

If you are a first-time buyer you can apply for a DIRT refund. New schemes have been introduced to help first-time buyers with the cost of buying or building their first home. These schemes are the:

- DIRT First-Time Buyers

- Help To Buy (HTB) incentive

Non-resident account holder

If you are not a resident in Ireland for tax and Ireland has a double taxation agreement with the country you are resident in, you may claim a refund of some or all of the Deposit Interest Retention Tax (DIRT) that you paid. You should complete a Form IC5 to claim a refund.

Dividend income from Irish companies

All companies resident in Ireland must deduct Dividend Withholding Tax (DWT) at 25% from the gross dividend paid (there are some exceptions). The Irish resident company paying the dividend is obliged to pay the DWT to Revenue.

If you are in receipt of dividend income from an Irish resident company, you should file a tax return and declare the gross amount of the dividend received. You are entitled to a credit for the DWT against your total income tax liability.

Download your FREE Self-Assessed Irish Tax Guide

Foreign dividend income

An Irish resident is, subject to some exceptions, liable to income tax in respect of his/her worldwide income. In some cases, part of that individual's income may also be subject to tax in another country.

If you have had foreign tax taken off dividend income that is also taxable in Ireland, you may be able to claim a Foreign Tax Credit. You can claim Foreign Tax Credit for all or part of the foreign tax you paid depending on whether or not Ireland has a Double Taxation Treaty with the country from which the dividend is received. You can only claim Foreign Tax Credit if a double taxation agreement allows both countries to tax the same item of income. If there is no double taxation agreement in place between Ireland and that country, a unilateral relief can be claimed.

Sometimes dividends received from foreign countries will suffer an Irish tax deduction on encashment. If this applies you will get a full credit against your Irish tax for this deduction. If you do not owe tax you will get a refund of the Irish tax deducted.

Preliminary tax

When filing a self-assessed tax return, it is normal to pay income tax based on the previous year's earnings (i.e. tax on income earned in 2023 is paid by 31 October 2024). Aside from your income tax liability, you will also have to pay Preliminary tax.

Preliminary tax is an estimate of the income tax, Pay Related Social Insurance (PRSI) and Universal Social Charge (USC) that you expect to pay for a tax year.

You calculate preliminary tax by choosing one of the following:

- 90% of the tax due for that year

- 100% of the tax due for the preceding year

- 105% of the tax due for the pre-preceding year (this option only applies where you pay by direct debit - it does not apply if the tax due for the pre-preceding year was zero)

If your taxable non-PAYE income is less than €5,000 in a year and your gross income from non-PAYE sources is less than €30,000 you will need to file a Form 12 income tax return. It will not be necessary to pay preliminary tax on a Form 12 tax return.

We take the hassle out of filing your Irish tax return

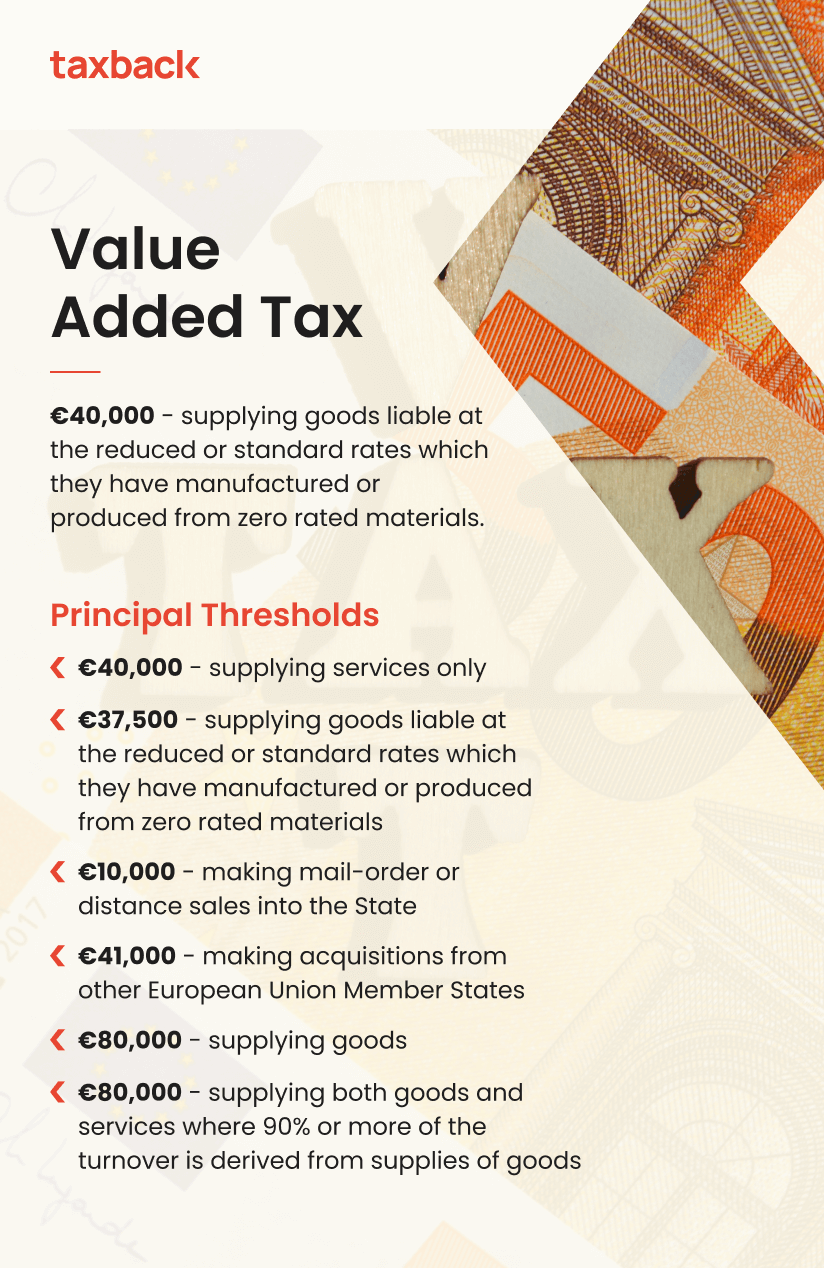

Value Added Tax (VAT)

You must register for Value Added Tax (VAT) if your annual turnover is more than (or is likely to be more than) €80,000 for supply of goods or €40,000 for supply of services.

As a trader you pay VAT on goods and services acquired for the business and charge VAT on goods and services supplied by the business.

The difference between the VAT charged by you and the VAT you were charged must be paid to Revenue.

If the amount of VAT paid by you exceeds the VAT charged by you, Revenue will repay the excess. This ensures that VAT is paid by the customer and not by the business.

If you are registered for VAT, Revenue will send you a form VAT 3 which must be returned with the payment not later than a specified date. Normally, VAT returns are made every 2 months. However, special arrangements can be made for small businesses to pay at less frequent intervals.

A taxable person

A taxable person is any person who independently carries on a business in the European Union (EU) or elsewhere. It includes persons who are exempt from Value-Added Tax (VAT) as well as flat-rate (unregistered) farmers.

An accountable person

A person who is required to charge VAT in the State is referred to as an accountable person. An accountable person is a taxable person (for example, an individual, partnership, company) who:

- supplies taxable goods or services in the State and

- who is, or is required to be, registered for VAT

Generally, you must register for VAT if you are an accountable person and you exceed or are likely to exceed the relevant VAT thresholds.

If you are setting up a business but you are yet to supply taxable goods or services, you should register for VAT as soon as it is clear that you will become an accountable person.

Farmers, sea fishermen and traders whose turnover is below the VAT thresholds are not generally obliged to register for VAT but may do so if they wish.

VAT thresholds

Value-Added Tax (VAT) registration is obligatory when the VAT thresholds are exceeded or are likely to be exceeded in any 12 month period. If you are below the thresholds you may elect to register for VAT.

The principal thresholds are as follows:

- €40,000 - supplying services only

- €37,500 - supplying goods liable at the reduced or standard rates which they have manufactured or produced from zero rated materials

- €10,000 - making mail-order or distance sales into the State

- €41,000 - making acquisitions from other European Union Member States

- €80,000 - supplying goods

- €80,000 - supplying both goods and services where 90% or more of the turnover is derived from supplies of goods

A non-established person supplying taxable goods or services in the State is obliged to register and account for VAT irrespective of the level of turnover.

Exempt persons

Exempt persons and non-taxable entities that acquire, or are likely to acquire, more than €41,000 worth of goods from other Member States in any 12 month period are obliged to register and account for Value-Added Tax (VAT) in respect of the acquisitions from other European Union Member States.

You may not reclaim VAT if you are an exempt or non-taxable person.

We take the hassle out of filing your Irish tax return

Approved and unapproved share schemes

If you are employed through the PAYE system, your employers may offer company shares (share awards or share options) to you, for example as a reward.

Share schemes can be both approved and unapproved in nature.

Examples of approved schemes include:

Approved Profit Sharing Schemes (APSS)

Approved Profit Sharing Schemes allow employers to give their employee shares in the company up to a maximum value of €12,700 per year tax-free. However, you must pay USC and PRSI on the value of the shares. Approved Profit Sharing Schemes are subject to certain conditions set out in legislation and administered by the Revenue Commissioners.

In Ireland, employees can get share options from their company that may be 'tax free' or 'tax efficient'. There are 2 main ways:

- Approved Profit Sharing Schemes

- Stock Options

If the scheme meets certain conditions, an employee pays no tax on shares up to a maximum value of €12,700 per year. The employer must hold the shares for a period of time (called the 'retention period' - generally two years from the date on which they were appropriated) and the employee must not dispose of the shares before 3 years.

If you dispose of shares before this time, then you're liable to pay income tax on whichever is the lower of the following:

the market value of the shares when they were given to you

or

the value of the shares at the time of sale

Approved savings related (or Save As You Earn - SAYE) share option schemes

If your employer grants you share options under an approved savings related share option scheme, you'll be exempt from IT on any gain you make when you exercise the options. Provided you don't exercise the share options within three years of receiving them.

There are two elements to this scheme:

- Save As You Earn (SAYE) - a certified contractual savings scheme

- An approved savings-related share option scheme.

Participation in the scheme is voluntary. You must save between €12 and €500 per month. You decide how much you want to save. Your employer may offer you a three, five or seven year savings contract. They will then deduct the savings amount from your net salary and place your savings on deposit with an approved bank or savings institution.

Once you complete the savings period, you can decide if you want to exercise your option to buy the shares. The amount you save must be enough to buy the shares at the option price set by your employer. Your employer sets the option price before you start saving. It may be set at a discount of up to 25% of the market value of the shares at the date of grant of the option.

If you decide not to exercise your option, the bank or savings institution will return your savings to you.

If you decide to exercise your option at the end of the savings period, you will not have to pay IT on any gain you make. However, you must pay USC and PRSI.

Approved Profit Sharing Schemes are subject to a number of conditions that should be checked with the Revenue Commissioners.

Unapproved share options

A share option is a right that your employer grants you, to acquire shares in the company. The shares may be at no cost to you (nil option) or at a pre-determined price your employer sets. You must pay Income Tax (IT) on any gain you make on the exercise, assignment or release of a share option.

Capital Gains Tax (CGT) may also be due when you dispose of your shares.

There are two types of share options:

- a short option, which must be exercised within seven years from the date it is granted

- a long option, which can be exercised after seven years from the date it is granted.

Short option

When you exercise a short option, you pay income tax on any gain you make. The amount of the gain is the difference between the market value of the shares when you buy them and the amount you paid for the shares (plus any amount paid for the grant of the option).

Long option

When you exercise a ‘long option’, you may have to pay income tax on the grant date and the date you exercise the option. You will only pay IT if the option price is less than the market value of the shares at the grant date. The tax is due on the difference between the market value of the shares on the grant date and the amount you pay when you exercise the option.

When you exercise the option, the tax is due on the difference between the market value of the shares on the date you exercise them and the amount you paid for the shares.

Any tax you pay on the grant of the option will be offset against any tax due when you exercise the option.

Examples on unapproved share schemes include:

Free shares

You can receive free shares under a formal share plan or a once off award as a benefit-in-kind by your employer. The value of the benefit is the market value of the shares at the date of the award.

The shares may be subject to a vesting period. If so, the value of the benefit is the market value of the shares at the date of vesting.

You pay Income Tax (IT), Universal Social Charge (USC) and Pay Related Social Insurance (PRSI) through the PAYE system.

Discounted shares

Your employer may give you the opportunity to buy shares in the company at a discounted price. The discount is the difference between the market value of the shares at the date of the award and the amount you pay for them.

You will pay IT, USC and PRSI on the discount amount. All deductions will be made through the PAYE System.

Forfeitable shares

Your employer may award you shares that are subject to forfeiture. For example, if you leave the company or fail to meet expected performance conditions. You must pay IT, USC and PRSI on the market value of any free shares awarded, or on the value of discounted shares. You will be charged tax on the date the shares are awarded even though they may be forfeited. All deductions will be made through the PAYE System.

If the shares are forfeited, any tax charged when they were granted will be reduced to nil. You will receive repayment of the tax overpaid. You must submit a written claim for repayment to your Revenue Office. You must do this within four years from the end of the tax year in which the shares are forfeited.

Convertible securities

A convertible security is a type of share or stock that can be converted into or exchanged for another type of share or stock. In this scenario, your employer will award you convertible securities. You must pay Income Tax, USC and PRSI on the market value of the securities at the date you received them. The deductions will be made through the PAYE system.

A further Income Tax charge may also arise if and when those securities are converted into or exchanged for other securities.

Restricted Stock Units (RSUs)

A Restricted Stock Unit is a grant (or promise) to you by your employer. On completion of a 'vesting period', you will receive either a number of shares in the company or the cash equivalent of shares.

You must pay IT, USC and PRSI either on the market value of these shares at the date of vesting or the cash payment (if you receive cash equivalent).

An employer needs Revenue approval to set up an approved scheme. Under approved share schemes, your employer can allocate up to €12,700 in tax-free shares to you annually. The shares must be held in a trust set up by your employer. If you leave the shares in the trust for three years you will be exempt from Income Tax (IT) but you must pay Universal Social Charge (USC) and Pay Related Social Insurance (PRSI) on the value of the shares. If you sell or transfer your shares before the end of the three years, you will have to pay IT on either the original shares value or the shares value at the date of sale or transfer, whichever is less.

You must pay IT, USC and PRSI on shares or options granted under unapproved schemes. Capital Gains Tax (CGT) may also be due when you dispose of your shares.

RTSO is due on the exercise of unapproved share options.

Your employer will usually make the necessary deductions from share awards through payroll and pay the tax directly to Revenue.

ESPPs

An ESPP is a way for employees to purchase shares in their company through payroll deductions, sometimes at a discounted price. Once you have enrolled in the plan, your company will collect your payroll contributions to purchase the shares on a specific date.

There is normally a 15% discount of the market value of the shares, on either the first day of the offer period or the last day of the offer period.

The discount is applied to the market value on whichever day had the lower value. The offer period is normally six months.

Generally, there'll be a maximum percentage of your salary that you can invest in the plan. You decide how much net salary or wages you wish to contribute to the plan. You contribute the same amount each month for a six month period. Your contributions are held on your behalf by the company, usually in a non-interest bearing account. At the end of the six months the contributions are used to purchase shares for you.

The discount allowed by the company is chargeable to Income Tax as a benefit derived from your employment. The amount chargeable is the difference between the market value of the shares when they were purchased on your behalf and the amount you pay for those shares.

You'll pay Income tax, USC and Employee PRSI on the amount of the discount. All deductions will be through payroll under the PAYE System.

Some ESPPs may be drafted in such a manner that would make them share option plans. This however, will depend on each individual plan.

Relevant Tax on Share Options (RTSO)

A share option is a right that your employer grants you to acquire shares in the company. Income tax will be due on any gain you make when you exercise, assignment or release the share option.

The tax due on the exercise of a share option is known as RTSO and this will be due within 30 days of exercising the options. You must also calculate the Universal Social Charge (USC) and Pay Related Social Insurance (PRSI) due.

You will have to file a RTSO1 Form when making your payment and also complete a Form 11 for every year that you exercise options.

*RTSO is due on the exercise of unapproved share options

We take the hassle out of filing your Irish tax return

Professional Services Withholding Tax (PSWT)

Professional Services Withholding Tax (PSWT) is a tax on payments made by an 'accountable person' for particular professional services (provided by a 'specified person').

An accountable person must deduct PSWT at the rate of 20% from such payments.

Accountable persons include:

- government departments

- local authorities

- Health Service Executive (HSE)

- authorised health insurers

- commercial and non-commercial semi-state bodies

- any subsidiary of the above or a body funded by any of the above

Professional services include:

- medical, dental, pharmaceutical, optical, aural or veterinary services

- architectural, engineering, quantity surveying or surveying nature, and related services

- accountancy, auditing or finance services

- financial, economic, marketing or advertising services

- legal services

- geological services

Payments excluded from PSWT