If you’ve ever earned income from a job in Canada, you’ve likely received a T4 slip.

But what exactly is a T4, and why is it important? Simply put, a T4—officially called the T4 Statement of Remuneration Paid—is a tax slip that summarizes how much you earned and how much tax was deducted in a given year.

You need it to file your tax return, and understanding it can help you maximize your refund. Let’s break it down in simple terms!

What is a T4?

The T4 is the key piece of paper that you will need in order to file your taxes in Canada.

Officially known as T4 Statement of Remuneration Paid, the slip provides most of the important information you need to complete your tax return.

You are required to report all your T4s in the year you earned the income.

Yeah yeah… but what is it in plain English?

It’s a summary of the income that you earned and the tax that you paid for the tax year in your job. You will receive a T4 for each job that you had.

Can’t find your T4? Contact your employer!

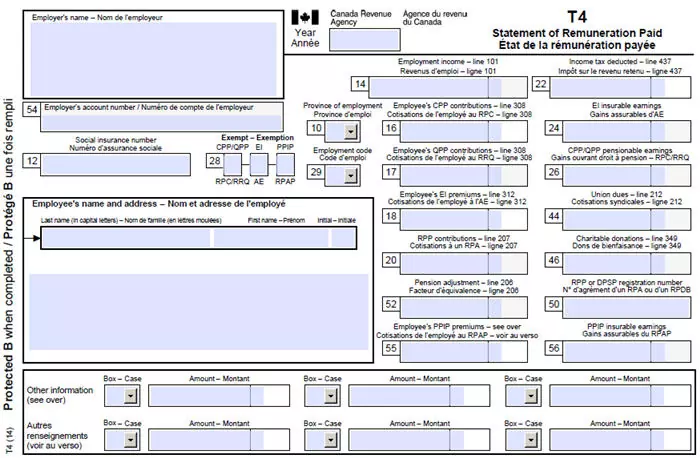

This is what it will look like. You may receive it by email or post, and it can be blue or pink.

Here is what you need to know about the T4, and what all the T4 boxes mean

First and foremost, you should find your Employers Name in the top lefthand corner of the T4

To the right of the Employer’s Name, will state the Tax Year in question (i.e. 2024, 2023, 2022, 2021, etc).

The large box on the left will contain your Name and Address

- Box 12 – this is your Social Insurance Number, or SIN

- Box 14 – this is the Income that you earned in this job

- Box 22 – this is the Income Tax that you paid

- Box 16 – this is a tax called CPP or Canadian Pension Plan. This is your pension plan in Canada.

- Box 18 – this is a tax called EI, or Employers Insurance. This tax goes to those who receive social welfare in Canada.

Ok, so what can be refunded?

In this case, we’re looking at 3 boxes: 22, 16 and 18.

Generally speaking, if you earned under the tax-free allowance for the tax year ($15,705 in 2024), you should be refunded the majority if not all of your income tax.*

You will only be refunded overpayments of CPP (Box 16) and EI (Box 18).

*This is based on a single person, earning less than $15,705 in the 2024 tax year, with no income outside of Canada. Please note that this is being used as an example only.

So here’s how you can read your T4.

Got any questions?!

You can call the CRA or ask a tax agent such as Taxback.

Last Updated on March 12, 2025