Starting a New Job in Canada: Essential Guide and Tax Tips

So you’ve landed a job in Canada. How exciting!

While the toughest part is over, you now have to fill in some lovely forms so that the government can tax your income!

The first thing you'll need before you can start working in Canada is a Social Insurance Number (SIN). You can apply for your SIN here even before you arrive in Canada.

Tax forms

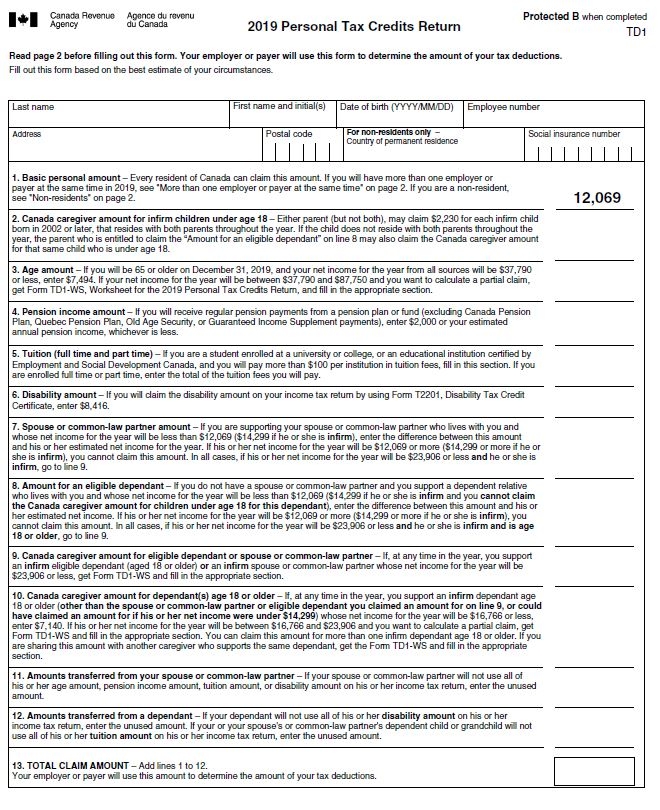

When you start a new job in Canada, your employer will ask you to fill out some tax forms. The forms in question are called Federal and Provincial personal tax credit forms. Employers use these forms to determine the amount of tax to be deducted from your employment income.

They look like this:

You need to complete these forms if:

- You have a new employer

- You want to change amounts from previous claimed tax years

- You want to claim the deduction for living in a prescribed zone

- You wish to increase the amount of tax deducted at source

The most common reason for filling out these forms are changing employers or starting your first job.

Usually everything is pretty straightforward, but you need to be careful if any of the following applies:

A) You were working in a different country in the same tax year that you arrived in Canada

If you earned income from another country in the same year you earn income in Canada, you might not be eligible to claim personal tax credits which allow you to earn money tax free in Canada.

In short, if you earn 90% of that year’s income in Canada, you can claim the tax credits.

However, if the income that you earned outside Canada was more than 10% of your total income in that tax year, you are not eligible to claim the personal tax credits on the Federal or Provincial TD1 form.

In this case, you should enter 0 in box 13.

B) You are working at more than one job

If you have more than one job you must make sure you don’t claim personal tax credits twice. It’s a good idea to claim the tax credits for whichever job pays the most. If you discover that you’ve claimed the credits twice, you should fill out the forms again.

Tax residency

If you have come to settle in Canada, remember you will initially be taxed as a newcomer. After the first tax year however, you will then be considered a resident of Canada for income tax purposes.

Non-residents pay tax only on their income from Canada, but once you are a resident for tax purposes, you pay tax on your worldwide income.

The Canadian tax year is from January 1 to December 31, but you can't apply for a tax refund until March 1 of the following year.

Your T4

After the end of the tax year (usually in February), your employer will issue a T4 to you. Your T4 is a statement of earnings for the previous year and shows how much tax you paid.

You can use this statement to help apply for a tax refund. How much you get back will depend on a number of factors, such as:

- Your residency status

- How long you worked

- How many jobs you had

- Income you received from overseas

- How much tax you paid

- If a tax treaty is applicable

Getting a refund

If you’re working in Canada temporarily, you’re obliged to file a tax return. While you'll need to file your return by 30 April, you can apply for your tax refund from March.

The average Canadian tax refund is $998

It's true that you can file your tax return yourself with the Canadian Authorities. However, if filling out boring tax paperwork sounds like the last thing you'd want to do, why not contact Taxback?

Our tax team will do all the work and transfer your tax refund to your bank account anywhere in the world.

To file your tax return, we’ll need a T4 or final cumulative payslip. To apply, you simply need to quickly register online here.

The tax year is from Jan 1 to Dec 31 and you have up to 5 years to claim your refund.

Use our tax refund calculator to find out how much Canadian tax you are owed!