Claiming Your Japanese Pension Refund: What Expats Need to Know

If you're an expat who worked in Japan, you might be eligible for a Japanese pension refund.

The good news is that you can potentially withdraw the first three years of your Japanese pension plan contributions as a lump sum refund and have it sent to your bank account (dattai ichi ji kin). To do that you must have worked there and contributed to the retirement fund for over six months.

Now, if you’re thinking that claiming your pension back won’t be worth your while, it’s time to think again!

The average Japanese pension refund is ¥600,000, so it’s well worth checking how much you could be due.

In order to claim a Japanese pension refund, you must not be a Japanese national or permanent resident in Japan.

If you have double citizenship (Japanese and any other country), you also cannot claim your retirement contributions back.

It’s important to know that you can only claim tax back the first three years of your contributions. In other words, if an employee worked for 4 years, he/she can only claim a pension refund in Japan for the first three years.

A refund of the shakai hoken (nenkin lump-sum withdrawal) or the retirement contributions can only be requested when you leave Japan, even temporarily. You can claim a tax back once you have left the country for at least 6-8 months.

Once you leave Japan, you have a period of two years to claim back your pension refund.

Who is entitled to receive a refund of Japan's pension for non-Japanese residents?

To be eligible for a lump-sum withdrawal, you need to meet certain conditions. These include:

-

being a non-Japanese citizen

-

not holding a Japanese visa

-

having paid into the National Pension or Employee Pension Insurance for over six months but less than 10 years

-

not having a registered address in Japan and not planning to return (or you have officially cancelled your residency registration there. You need to apply for the pension refund within 2 years from the date you have left Japan

-

never having received any pension in Japan, including Disability Allowance.

What documents do I need when applying for my Japanese pension refund?

1. You need to provide a copy of your passport, including the pages with your name, date of birth, nationality, signature, as well as the page with the date of your final departure from Japan.

2. To make a claim, you'll need to provide some documents from your bank, such as a copy of your passbook, online statement, or void cheque. These documents should have your bank's name and address, your account number, and information showing that you're the account holder. You'll also need to provide your IBAN or SWIFT/BIC code.

3. Additionally, you need a copy of your Basic Pension Number and a document that shows your Resident Register Code.

How much money can I get back from my Japanese pension refund?

How much money can I get back from my Japanese pension refund?

The amount a foreigner can receive in their pension refund will depend on the number of months they have worked in Japan and the amount contributed to the fund. The refund rate is typically based on the number of months they made payments for the National Pension Scheme and Employee's Pension Insurance Scheme (EPI). Discover your potential tax savings with our user-friendly Japan tax calculator today!

It's important to note that the pension refund payments stop after 36 months (3 years). This means that even if a foreigner contributes to the retirement scheme for six years, they'll only get a refund for up to 36 months if they choose to get their pension refunded. Any remaining payments won't be considered. If a foreigner gets a refund and later returns to Japan for work, they'll have to start their pension scheme contributions again, and their previous payments won't count.

Will I have to pay income tax on lump sum withdrawals?

If you withdraw your refund as a lump sum, you'll have to pay 20% in income tax, which means you'll only get 80% of your total payment at first.

The good news is that you can get the 20% tax refunded because you won't have to pay income tax in Japan anymore. To get your refund, you need to appoint a tax representative.

Apply for Your Japanese Pension Refund Now

Here are 6 simple steps you need to follow when applying for your Japanese pension refund:

1 - Leaving Japan

When you have your ticket to leave Japan, be sure to get your residency de-registered.

You will have to submit a “moving out notification” (tenshutsu todoke) to your municipal office two weeks before your departure and apply for a residence certificate with your Resident Register Code right after submitting the move-out notice.

This will help your Japanese pension refund application to be processed more quickly. What’s more, you will also be able to avoid city taxes from being collected during the time you are away.

If your visa is still valid and has not yet expired, you will be required to have it cancelled.

2 - Starting the process

As soon as you arrive in your home country (or another country where you are going), start the process immediately. It can take 6-8 months for payment, so don't waste time.

3 – You must be outside of Japan for at least 6-8 months

You should plan to stay for at least 6- 8 months outside of Japan (in your home country or another country), in order to apply to withdraw your Japanese pension refund, as this is the average time that it takes for such an application to be processed by the Japanese pension service.

4 – Keep your residence card

You will need your zairyu card or gaijintoroku or at least a copy of the front and backside. It will make the application process faster.

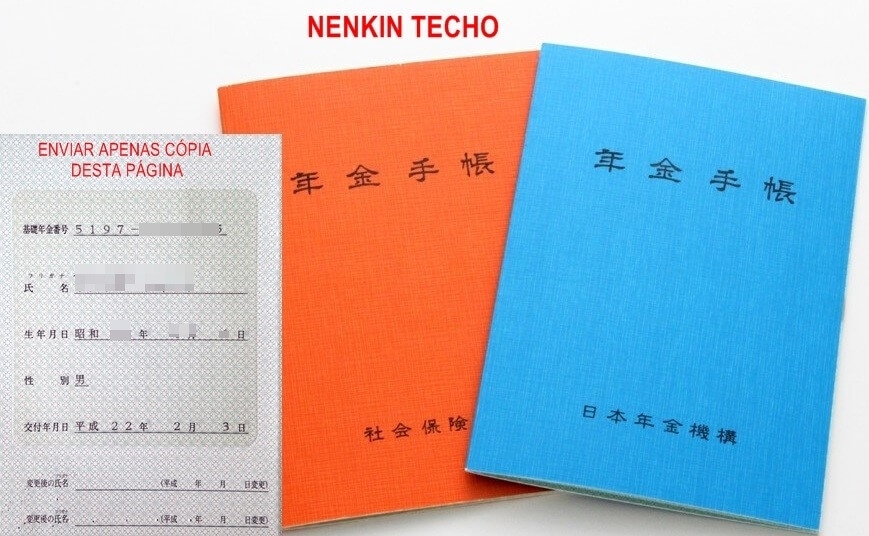

5 - Keep your nenkin booklet (see example below)

This is one of the essential documents to request a Japan tax refund. If you have not received or lost it, ask your employer for one.

6 - Keep your gensen

Ask for the last gensen (your yearly statement) from your employer as soon as you stop working. It is likely that you also have an income tax to repay.

What is the easiest way to apply for your Japanese pension refund?

You can apply for your Japanese pension refund directly yourself.

But the easiest way to get your retirement contributions back is to do it with Taxback.

We will deal with all the tricky paperwork, communicate with the Japanese authorities on your behalf and the refund will be paid straight to your bank account.

The average Japanese Pension Refund a Taxback customer claims is ¥600,000.

Why choose Taxback?

Thousands of people choose our service because:

- You get the maximum tax refund possible

- Your refund is delivered to any bank account worldwide and in your local currency

- You don’t need to fill out complicated forms. Just sign and post to us the requested documents