What’s a P60 and what expenses you can claim in the UK

Did you know your P60 can help you get a rebate?

Your P60 is an important document and you shouldn't just stuff it in a drawer! Your employer should give you your P60 after the end of the tax year if you were working for them on April 5 and the deadline for employers to give you this document is May 31.

Average Rebate £963

So..what exactly is a P60 form?

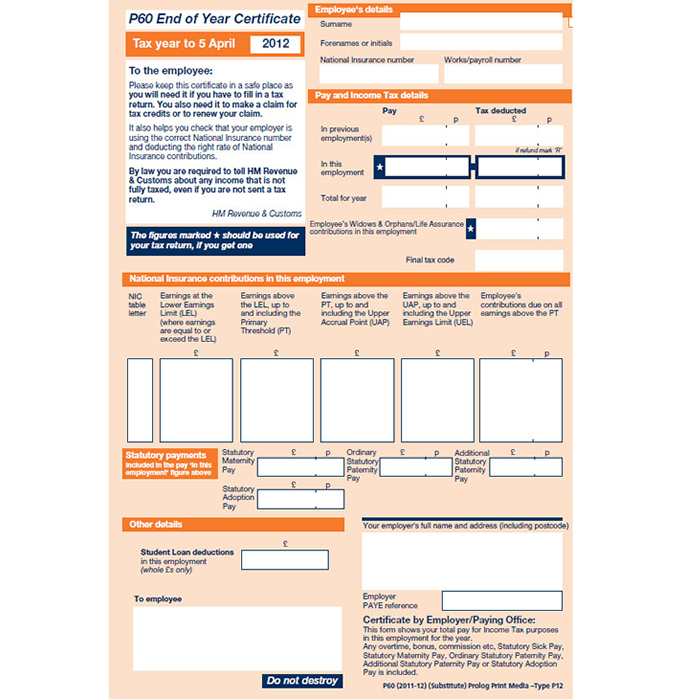

Sample P60 Form

Your P60 is a document that states your earnings and summarises any deductions from your income such as tax and National Insurance Contributions. The information on this document can help our tax team determine if you have overpaid tax, leading to a potential UK tax refund! We can check things like your tax code and any other expenses you may be able to claim to maximise any possible rebates.

We all know it’s a drag to pay taxes...especially when you look at your payslip and ask yourself where has all that money gone?! Luckily, if you’re a PAYE employee in the UK there are a number of items you may be able to use to claim tax relief. How much you can claim will depend on the rate of tax you paid. For example, if you paid £80 on a claimable expense at a rate of 20%, the tax relief you can claim will be £16.

Download your FREE UK Tax Guide

Expenses that you may be able to use to claim tax relief!

You can either claim:

- For what you’ve spent - you’ll need to keep receipts

- A ‘flat rate deduction’

Flat Rate Deductions

HM Revenue and Customs (HMRC) has a list of occupations that qualify for tax relief at set amounts. The list covers different types of industries and roles including pilots, police, agricultural workers and the armed forces. Even if your particular occupation isn't on the list, you may still be able to claim the standard annual allowance of £60.

You won’t need to keep records of what you’ve paid for if you claim a flat rate deduction. At Taxback, we can check if you're due any relief in the form of a flat rate deduction when you apply for a tax rebate!

Average Rebate £963

Expenses you can claim

The most important rule to remember for an expense to be allowable is that it must be incurred wholly, exclusively and necessarily in the performance of the duties of the employment.

Other rules include:

- You can only claim for items used for work and not in your private life

- You must have paid for the expenses yourself

- You can’t claim on items where your employer has provided an alternative

- You must have paid tax in the year you paid for the expense

- You must not have been reimbursed for the expense OR if your employer reimbursed the expense but you were taxed on the reimbursed amount it should be included in your taxable earnings or reported on a Form P11D, so you can claim relief at the end of the tax year

- You should keep all records of expenses

- Claim tax rebates within 4 years of the tax year that you spent the money

Uniforms and tools

If you use them for your job, you might be able to claim relief on the cost of:

- Repair or replacement of tools (for example saw, scissors, drill)

- Cleaning, repairing or replacing specialist clothing such as a uniform or safety hat

You cannot claim on the initial cost of purchasing these items. In this case, you either can claim the cost of what you paid and keep the receipts or claim it as a ‘flat rate deduction’.

Average Rebate £963

Capital Allowances

While it is unlikely as a PAYE UK employee, if you have any other tools or equipment you must purchase for your job, you may be able to claim them as an annual investment allowance.

What you can claim

You can claim on plant and machinery up to the qualifying amount permitted for an annual investment allowance (AIA). This means that you can deduct the full cost of the equipment before tax.

Examples include:

- Lorries, vans, trucks

- Integral Parts of a building including lifts and water heating systems

You cannot claim:

If you’re an employee you cannot claim for cars motorbikes, and bicycles used for work under this scheme, however, you may be able to claim for business mileage and fuel costs.

The average UK tax rebate is £963

Business mileage, fuel, and electricity costs

You may also be able to claim on the costs of fuel or electricity you use for business purposes. Exactly what you can claim really depends on whether you use your own car or a company car.

Remember, you can’t claim the cost of travelling from home/rented accommodation to your workplace unless it’s a temporary place of work. Only the cost of travelling in the performance of duties is allowable. For example, from your workplace to the office of the client.

Download our free guide to UK PAYE taxes here

Using your own vehicle

If you use your own vehicle then it might qualify for Mileage Allowance Relief which lets you claim your business mileage for the year and multiply it by approved rates.

You can only claim the full relief if your employer doesn’t pay it to you. However, if they pay you less than the full amount, then you can claim relief on the difference.

You should keep records of all mileage for your work journeys!

Using the company car

You can claim tax relief on the cost of fuel or electricity when using your company car for business. If your employer reimburses part of the cost then you can still claim on the difference. Again, it’s important you keep records of all trips.

Travel and overnight expenses

If you need to travel for work then you may be able to claim tax relief on the cost of overnight expenses and food.

Examples include:

- Public transport

- Hotel accommodation

- Food and drink

- Tolls and parking

- Business phone

- Business mileage

Fees and subscriptions to approved organisations

If you pay fees to join an approved professional organisation as part of your job (or if it’s helpful to your work) then you can reclaim tax on the fees.

You should have paid the fees for yourself and cannot claim lifetime subscriptions.

If you want to know exactly how much you can claim then you should contact the organisation and they should tell you.

Average Rebate £963

Working from home

Note: You may no longer be eligible for this tax relief if you previously claimed it while working from home due to the coronavirus (COVID-19).

Working at home regularly? Then you might be able to claim for the bills you pay in the course of your work!

How much you can claim

You can only claim for the cost of items used solely for business purposes and not for private use and for any claims over £6 per week, you must retain all receipts (£6 per week from 6 April 2020, for previous tax years the rate is £4 a week).

You will receive tax relief based on your tax rate.

Who can claim this tax relief

You can claim this tax relief if you have to work from home for instance because:

- Your job requires you to live a long way from your office

- Your employer does not own an office

You can only make claims for things related to your job, such as:

- Business phone calls, as well as gas and electricity for your workspace

- You cannot claim for items used for both personal and business purposes, such as broadband access or rent

The average UK tax rebate is £963

How to Claim

You can claim tax relief on expenses up to £2500 on the HMRC website or by posting Form P87 if you haven’t already filled in a UK self-assessment tax return. For claims over £2500 then you’ll need to fill in a self-assessment tax return and submit this to HMRC.

Taxback can also help you claim any expenses by preparing and submitting a tax return on your behalf!

You simply give our ISO-certified tax team a little info and we’ll do the rest! You'll get online updates and access to 24/7 help.

Claim your tax back now!

Download your FREE UK Tax Guide

Get Started!

The average UK refund is £963 so it’s definitely worth finding out how much you can claim!

If you're wondering 'How much tax am I owed?' You can start by getting an estimate of any possible rebate using our online tax calculator. Simply click here to get an estimate for free or email info@taxback.com if you have any questions!

Taxback can help you get a tax rebate! Who wouldn't want more money in their pockets?!