Your Bullsh*t-Free Guide to Australian Working Holiday Taxes

Visa and residency status

Hoping to embark on a working holiday in Australia? There are two visa subclass options which can facilitate this.

- 417 (Working Holiday)

- 462 (Work and Holiday) (backpackers)

Working holidaymakers visa - subclass 417

The Working Holiday visa (subclass 417) is a temporary visa for young people who want to holiday and work in Australia for up to a year.

This working holidaymaker visa allows you to:

- stay in Australia for up to 12 months

- work in Australia, generally for up to six months with each employer

- study for up to four months

- leave and re-enter Australia any number of times while the visa is valid

More information on how to qualify for a visa subclass 417 can be found here.

Want to Learn More About Australian Tax?

DOWNLOAD YOUR FREE TAX GUIDE HERE

Work and holidaymakers – visa subclass 462

This visa is for young people who want to holiday and work in Australia for up to a year. This is a good enough reason to get a better understanding of Australian working holiday taxes.

This visa allows you to:

- stay in Australia for up to 12 months

- work in Australia, generally for up to six months with each employer

- study for up to four months

- leave and re-enter Australia any number of times while the visa is valid

- apply for a second Work and Holiday visa if you have worked for three months in northern Australia in tourism and hospitality or agriculture, forestry and fishing

You can find more information on this visa here.

Or, if you are unsure of your visa status, you can check it by using the Visa Entitlement Verification Online service.

Residency status

One of the biggest factors affecting how you're taxed in Australia is whether you're a non-resident or resident for tax purposes.

All working holidaymakers entering Australia are considered non-residents for tax purposes. The main difference between tax for residents and non-residents is that non-residents pay 15% on their first $45,000 and residents pay 0% on their first $18,200 and 19% from $18,200 - $45,000.

Starting work - look for a registered employer

When you're applying for a job in Australia, make sure your prospective employer is registered to hire working holidaymakers, as this can have many implications on your Australian working holiday taxes. Registered employers will charge working holidaymaker rates at 15% on income up to $45,000.

However, non-registered employers are obliged to withhold tax at the higher non-resident rate of 32.5% on income up to $45,000. So it's in your interest to make sure you only work for employers who are registered to hire working holidaymakers.

Any employer can hire working holidaymakers and it's especially useful if they need a labourer or employee for a short amount of time.

Tax rates

If you work in Australia, tax will be withheld from your pay and you'll be obligated to lodge a tax return each year.

Regardless of the visa subclass, all Australian working holidaymakers are considered non-residents for tax purposes.

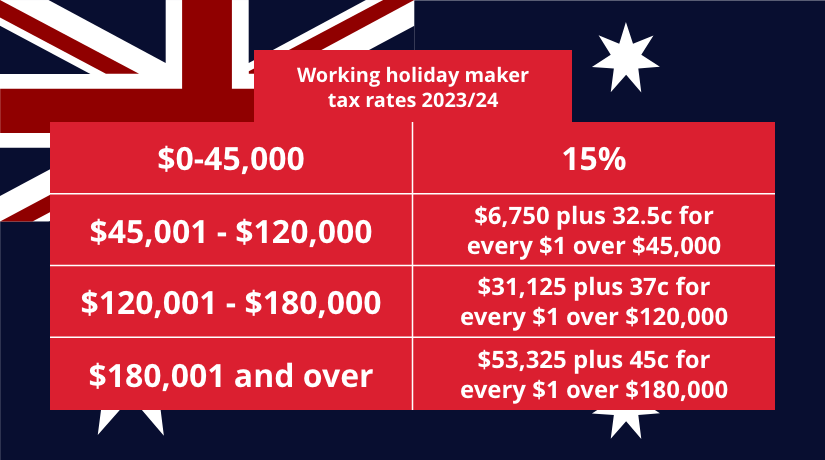

2023-24 income tax rates for working holidaymakers:

There's further information on income tax rates later in this guide.

Note you could be considered a resident for tax purposes in Australia if you meet the residential requirements and are from one of the following countries:

- Chile

- Finland

- Germany

- Israel

- Japan

- Norway

- Turkey

- United Kingdom

Medicare Levy

Residents of Australia are subject to a small levy deducted from their taxable income at 2%. It guarantees Australians and some other nationalities (Britons and Italians) access to healthcare at little or no cost.

However, foreign residents don't need to pay the Medicare Levy. If you aren't an Australian resident for tax purposes for the whole tax year, then you're exempt from the Medicare levy, offering a notable exception in the realm of Australian working holiday taxes.

Some people are exempt from paying the levy yet it still gets deducted from their wages. These people should apply for an exemption letter which will boost their refund.

If you've been paying the levy and it turns out you qualify for an exemption, you could be entitled to some tax back.

Taxback can also apply for a refund of the medicare levy if you were charged but not required to pay it.

Tax file number (TFN)

Your tax file number (TFN) is your personal reference number in both the tax and Superannuation (more on this below) systems.

Your TFN is yours for life. Even if you change your job, or even your name, you keep the same TFN - so it's important to keep it secure.

It's true that you don't necessarily need to have a TFN. But without one you pay more tax. It's also not possible to apply for government benefits, lodge a tax return electronically or get an Australian business number (ABN) without a TFN.

To apply for a TFN you will need a valid passport and an Australian address where your TFN can be sent to. Your TFN will normally arrive within 28 days after you complete your application.

More information on how you can apply for a TFN can be found here.

Tax returns

If you were a working holidaymaker in 2019-20 or before that – the first $37,000 of your income is taxed at 15%, with the balance taxed at ordinary rates, reflecting the evolving landscape of Australian working holiday taxes.

However, this has been increased to 15% on the first $45,000 for 2020-21 and future tax years.

If you earn less than this per year during your working holiday in Australia, you are not legally required to file a tax return. However, the vast majority of working holidaymakers are entitled to tax reclaim in Australia. By lodging your tax return, you can claim your working holiday tax refund. The average Australian refund a Taxback customer receives is $2,600. Tax returns cover the financial year from 1 July to 30 June of the following year, and if you're lodging your own return, the deadline is the 31 October.

You will need to lodge a tax return if you have Australian income, including:

- employment income

- rental income

- Australian pensions and annuities, unless an exemption is available under Australian taxes

- capital gains on Australian assets

Our average Australian tax refund is AU$2600

Lodging a tax return

The Australian income year ends on 30 June each year. You are required to lodge a tax return in Australia to make sure you have paid the right amount of Australian tax during your working holiday visa.

When you lodge a tax return, the Australian Tax Office work out how much tax you should have paid based on your actual income for the year. If too much income was withheld from your pay, you will be entitled to a tax refund in Australia. Or, alternatively, if you have underpaid tax you will be sent a bill to settle your liability.

When completing your tax return you can ignore any income from which non-resident withholding tax has been deducted, such as bank interest and unfranked dividends.

Further information on tax returns can be found here.

Lodging a tax return early

If you leave Australia permanently before 30 June, you can choose to lodge your tax return early.

Tax free threshold

If you're an Australian resident for tax purposes, the first $18,200 of your yearly income isn't taxed. This is called the tax-free threshold. Backpackers on 417 and 426 Visas are not able to use the tax-free threshold of $18,200, unlike Australian residents.

However, factors such as how long you've been in the country and your behaviour while you're in Australia, can influence whether you'll be seen as a resident in the future.

For example, if you come on a backpacker Visa from one of these eight countries (Chile, Finland, Germany, Israel, Japan, Norway, Turkey, or United Kingdom) and you're staying in Australia for longer than six months, live in the same place and establish ties with the local community, then you'll likely be considered an Australian resident for tax purposes. This means that you may be able to claim the majority of tax withheld at source by your Australian employers after the end of the financial year (June 30).

Superannuation

Superannuation is a system for employees in Australia to collect enough funds to replace their income in retirement.

If you're over 18 and earn more than $450 per month (before tax) then your employer must pay 11% (since July 2023) of the value of your ordinary time earnings into a super fund on your behalf.

Like Australian residents, students working in Australia also have to pay super.

However, when you leave Australia, you can reclaim your super as a Departing Australia Superannuation Payment (DASP) if you meet all requirements.

More information on Superannuation can be found here.

The average superannuation refund is $1908

Tax refunds

Thousands of working holidaymakers are entitled to a tax refund every year. There are countless reasons for this, including missing out on tax relief entitlements or simply overpayment of tax.

You can apply for your tax refund when you lodge your tax return. Alternatively, you can enlist the help of a tax agent like Taxback. We've been getting Australian tax refunds for our clients since 1996.

Our team of tax accountants will lodge your tax return for you and guarantee to get you your maximum legal tax refund.

Our average tax refund is AU$2,600. Apply today!

Income Tax Rates

Australian working holidaymakers are considered foreign residents for tax purposes.

The tax rates for working holidaymakers are listed below.

2023/24 income tax rates for working holidaymakers

Withholding amounts

If you do not supply your Tax File Number (TFN) to your employer when you start your job they must withhold 45% of your wages regardless of your level of income.

Withholding amounts are always rounded up to the nearest dollar. In other words, values ending in 50 cents and higher are brought up to the next higher dollar.

Example

David is living and working in Australia on a work and holiday visa (subclass 462). He earns $2,500 per month ($30,000 a year).

He has not yet applied for his TFN, therefore his employer must withhold 45% - $1,125 per month - of his earnings. Had he supplied a TFN, his monthly tax liability would be $375.

Summary

Your employer must withhold 45% of your wages if:

- you have not quoted your TFN

- you have not claimed an exemption from quoting your TFN

- you have not advised that you have applied for a TFN

If you advise your employer that you have applied for a TFN you will then have 28 days to provide them with your TFN before the withholding amount applies.

Want to Learn More About Australian Tax?

DOWNLOAD YOUR FREE TAX GUIDE HERE

Superannuation

Superannuation (super) is a system for employees in Australia to gather enough funds to replace their income in retirement. If you're over 18 and earn more than $450 per month before tax then your employer must pay 11% of the value of your ordinary time earnings into a super fund on your behalf.

Your payslip details the amount of super you're getting and the date it's paid into your fund.

If you would like further details on the account into which the super is being paid it is best to speak with your employer.

Ineligibility for super

You will not be eligible for super if you:

- earn less than $450 per month

- are under 18 yrs. And are working less than 30hrs per week or less

- are a non-resident paid for work performed outside Australia

- are a resident paid by non-resident employer for work done outside Australia

- are employed for domestic or private work for 30hrs per week or less

Setting up a super fund

It's common for employers to set up super funds on their employee's behalf. But, the option is also available to set your own fund up. You can do this when you open a bank account with any of the main banks in Australia.

If you are a working holidaymaker, it is probably a good idea to set up your own super fund. This is especially true if you intend to travel around and work in a number of jobs. Trying to keep track of your super payments can get very complicated and confusing if you have multiple accounts.

With one super account, you can keep all the funds in one place and it will be easier for you to claim it back when you leave.

Benefits of setting up your own superannuation account:

- You can keep all your super in one place (even if you have multiple jobs)

- There is less paperwork and you will not have to chase your employers

- It helps you to maximise your refund so you get all you're due

Types of funds

There are five basic types of superannuation fund:

1) Industry funds

The larger industry super funds are open for anyone to join. Some others are restricted to employees in a particular industry. The main features of an industry fund are:

- They usually have a smaller number of investment options, which will meet most people's needs

- They are generally low to mid-cost funds

- They are 'not for profit' funds which means profits are put back into the fund for the benefit of all members

2) Retail funds

These funds are run by financial institutions and are open to everyone, providing a diverse range of choices in the context of Australian working holiday financial planning.

Retail funds are usually run by banks or investment companies and are available for anyone to join.

These funds:

- often have a large number of investment options, sometimes in the hundreds

- are usually recommended by financial advisers who may be paid for their advice by fees and/or a commission

- are usually accumulation funds

- are mostly from mid to high cost, but some are now offering a low cost

- are usually operated by a company that is aiming to retain some profit

3) Public sector funds

Public sector funds were created for employees of Federal and State government departments. Most are only open to government employees.

The main features are:

- Some employers contribute more than the 11% minimum

- A modest range of investment choices are available to meet most people's needs

- Many long-term members have defined benefits, newer members are usually in an accumulation fund

- They generally have very low fees

- Profits are put back into the fund for the benefit of all members

4) Corporate funds

A corporate fund is arranged by an employer, for its employees, a relevant consideration for those in the realm of Australian working holiday employment.

Some larger corporate funds have an employer who also operates the fund under a board of trustees appointed by the employer and employees. Other corporate funds may be included as a separate part of a large retail or industry super fund (especially for small - and medium-sized employers).

Features of these funds include:

- Funds run by the employer or an industry fund will usually return all profits to members while those run by retail funds will retain some profits

- Those managed by a larger fund may offer a wider range of investment options

- They are generally low to mid cost funds for large employers but may be high cost for small employers

- Some older corporate funds have defined benefit members, most others are accumulation funds

5) Self-managed super funds (SMSFs)

SMSFs work like any other super fund, but the responsibility of managing them, including their investment decisions and legal responsibilities) rests solely with the trustee (you). Establishing and operating an SMSF is a major financial decision and you should first discuss your personal circumstances with a qualified professional.

How to keep track of super savings

By assigning your TFN number to your super fund, you can easily keep track of your money, move it between accounts, and receive super payments from your employer or the government. This is a crucial aspect to consider in the context of managing your finances during your Australian working holiday.

By creating a myGov account you can:

- see details of all your super accounts, including any you have lost track of or forgotten about

- find ATO-held super.

- combine multiple super accounts by transferring your super into your preferred super account. If this is a fund-to-fund transfer it will generally be actioned within three working days

You can also keep track of your super via your payslip. As per the 2012 Tax and Superannuation Laws Amendment, it's mandatory for any pay slips issued by employers to state:

- the amount of superannuation contributions per employee

- the date they will be paid, and

- the details of the fund they will be paid into

When is superannuation paid out?

Superannuation is a pension system and is paid out to Australians when they retire. However, if you don't plan on retiring in Australia, you can claim Australian super back when you leave.

Note: Tax will be due when you reclaim your Australian superannuation fund.

If you are or were on a temporary visa in Australia (except subclasses 405 and 410) and you don't want to retire there, you can and should claim back your superannuation.

The refund is called a 'Departing Australia Superannuation Payment' (DASP) and you can only claim it if your visa has expired and you've left Australia.

Superannuation refunds can be a hefty sum. The average super refund through Taxback is $1,908. However, the amount you will get back will depend on how long you worked in Australia and the contributions your employer made.

Also, if you lose any important information relating to your super fund, Taxback can help you recover it.

It's also important to note that you will be perfectly entitled to return to Australia on another visa, even if you claim your superannuation money.

The average superannuation refund is $1908

DASP tax

It's important to note that if you are a working holidaymaker on either a 417 or 462 visa, and your Departing Australia Superannuation Payment is processed on or after 1 July 2017, your superannuation refund will be taxed at a rate of 65%.

If you are on any other visa, your super refund will be taxed at 35%.

How to claim it back

Once you've left Australia and your visa has expired, you have a number of options to choose from in order to claim your super refund.

Firstly you can apply directly yourself for your super refund. Or alternatively, you can contact a tax refund agent like Taxback. We can help you get your super back and even help get your visa cancelled for you if it hasn't expired!

Reasons to apply with Taxback:

- All of the paperwork will be taken care of for you

- We'll chase up the ATO to maximise your refund

- We'll help you retrieve any missing info or documents

- We'll update you so you can get on with life while we get your super back for you!

- Free, no-obligation refund estimate first

Ineligibility for super refund

The following people are unable to claim a super refund:

- Australian citizens

- New Zealand citizens

- Permanent Australian residents

- Retirement visa holders

- Investor retirement visa holders

- If you're a New Zealand citizen permanently leaving Australia, you may be able to transfer your fund to New Zealand

Leaving Australia

If you worked in Australia as a working holidaymaker, and have now returned to your home country, you can still lodge your tax return and apply for your tax return.

There are three options for doing so – online, with a paper tax return or through a tax agent like Taxback.

If you are leaving Australia permanently you may be eligible to lodge an Australian tax return early. This process is essential for anyone considering their obligations related to Australian working holiday taxes. However, to do this you must choose to file a paper return.

During your time working in Australia it is likely that you will have been paying Superannuation (super). Super is a system for employees in Australia to collect enough funds to replace their income in retirement. If you're over 18 (including students and working holidaymakers) and earn more than $450 per month (before tax) then your employer must pay 11% of the value of your ordinary time earnings into a super fund on your behalf. If you paid Super you will be entitled to reclaim it through a Departing Australia Superannuation Payment (DASP - if you meet all the requirements).

You can claim your super after you leave if you:

- were in Australia on an eligible temporary-resident visa (but not if you were on visa subclasses 405 and 410)

- had super contributions paid by an employer while you were in Australia

- have left Australia and your working visa has either expired or been cancelled

Before your super is paid to you, your fund will deduct tax.

If your Departing Australia Superannuation Payment was processed on or after 1 July 2017, your superannuation refund will be taxed at a rate of 65%.

This change only applies to working holidaymakers on 417 and 462 visas. If you are on any other visa, the change doesn't affect you and your super refund will still be taxed at 35%.

Note: New Zealand citizens and permanent residents of Australia are not eligible for the Departing Australia Super Payment. The Trans-Tasman Retirement Savings Portability Scheme permits transfers of retirement savings between super funds for people who emigrate from one country to the other.

Our average Australian tax refund is AU$2600

Zone Tax Offsets are tax concessions for people who live in remote areas of Australia. They are designed specifically to assist with the higher cost of living, amenities and other environmental factors associated with remote living. So, if you go to Australia and live in a remote area, you may be able to claim it.

How much can be claimed?

The current single person annual rates are:

- Zone A offset value is $338

- Zone B offset value is $57

- Special zone areas offset value is $1,173

Click here to download the full list

Australian Taxes Eligibility

Eligibility for the zone tax offset is based on your usual place of residence. If your usual place of residence was not in a zone, you are not eligible for the zone tax offset.

From 1 July 2015, you can only claim the zone tax offset if your usual place of residence is in a remote or isolated area (known as a zone) during the income year.

If your usual place of residence was in a zone for less than 183 days in the income year, you may still be able to claim the tax offset if your usual place of residence was in a zone for a continuous period of less than 5 years and:

- You were unable to claim in the first year because you lived there less than 183 days

- The total number of days you lived there in the 1st year and current income year is 183 or more. The period you lived in a zone in the current income year must include the first day of the income year

Before 1 July 2015, you must have lived or worked in a remote area (not necessarily continuously) for either:

- 183 days or more during the income year

- 183 days or more in total during the current and previous income years – but less than 183 days in the current year and less than 183 days in the previous income year – and have not claimed a zone tax offset in your previous year's tax return

Our average Australian tax refund is AU$2600

Examples of Eligibility

Example 1

Martin lived in a remote area from 1 March 2019 to 30 September 2023 a continuous period of less than five years. He couldn't claim a zone tax offset for the 1st year because he only lived there for 122 days.

However, he could carry forward these unused days to 2023–24.

He adds the number of days from 1 March 2019 to 30 June 2019 (122 days) and the number of days from 1 July 2023 to 30 September 2023 (92 days).

As the total (214 days) is '183 days or more' over the two income years, Martin can claim the tax offset on his 2023/24 tax return.

Example 2

Levi is an engineer in Adelaide. He flies to Alice Springs for 12-day shifts at an engineering firm and returns to Adelaide for his days off (4-8 continuous days).

As Levi does not have his usual place of residence within a prescribed zone, even though he is in Alice Springs for 183 days or more, he is unable to claim the zone tax offset.

At Taxback our team can let you know if you're eligible to claim the Zone Tax Offset.

Australian working holiday tax deductions

If you earn less than $45,000 per year during your working holiday in Australia, you are not legally required to file a tax return. However, the vast majority of working holidaymakers are entitled to claim a tax refund. By filing your tax return, you can claim your tax refund. The average Australian refund a Taxback customer receives is $2,600.

The good news is that there are a number of tax deductions you can make to reduce your overall tax liability.

So what counts as a tax deduction?

Well, as a rule of thumb, if you need to spend money to earn income, you can usually claim it as a deduction.

To be a legitimate expense claim, you have to be able to show:

- you need to incur the expense to earn the income

- the expense is not private or domestic in nature

- the expense is not an outgoing of capital or of a capital nature related to a capital asset

And, to claim a work-related deduction:

- you must have spent the money yourself and weren't reimbursed

- it must be directly related to earning your income

- you must have a record to prove it – so it's vital to keep all receipts!

If the expense was for both work and private purposes, you can only claim a deduction for the work-related portion.

Below are examples of expenses which are allowable deductions.

Vehicle and travel expenses

If you have vehicle or travel expenses that are directly connected with your work you can include these on your list of deductions. However, you generally can't claim for normal commutes to and from work (considered private travel).

You can claim the cost of travelling:

- directly between two separate workplaces – this is applicable if you have a second job (providing one of the places isn't your home)

- from your normal workplace to an alternative workplace (for example, if you are going to a meeting at a client's premises), and back to your normal workplace or directly home

- if your home was a base of employment – you were required to start your work at home and travel to a workplace to continue your work for the same employer

- if you had shifting places of employment – you regularly work at more than one site each day before returning home

- from your home to an alternative workplace (not regular) for work purposes, and then to your normal workplace or directly home

- if you need to carry bulky tools or equipment your employer requires you use for work and couldn't leave them at your workplace – for example, an extension ladder

But you can't claim travel expenses:

- from doing minor work-related tasks on your commute to work – such as picking up the mail

- you have because you had to drive between your home and your workplace more than once in a day

- from being on call

- that you have because there is no public transport near where you work so you have to drive

- you incur because you work outside normal business hours – for example, shift work or overtime

- that you incurred when you commuted from your home, which was where you ran your own business, to a place of work where you worked for somebody else

Want to Learn More About Australian Tax?

DOWNLOAD YOUR FREE TAX GUIDE HERE

Itinerant work

You can only count your home as a workplace if you carry out itinerant work (or have shifting places of work).

In this case, you can claim the cost for driving between workplaces and your home.

How to tell if you do itinerant work:

- Travel is a fundamental part of your work, as the very nature of your work,

- You have a 'web' of workplaces you travel to, throughout the day

- Your home is a base of operations – if you start work at home and cannot complete it until you attend at your work site

- You are often uncertain of the location of your work site

- Your employer provides an allowance in recognition of your need to travel continually between different work sites and you use this allowance to pay for your travel

Car expenses

A car expense is considered as claiming a deduction for using your own car in performing your employment duties (including a car you lease or hire). If you use someone else's car for work purposes, you may be able to claim the direct costs (such as fuel) as a travel expense.

However, you can only claim expenses that relate to work. In other words, if the travel was partly private, you can claim only the work-related portion.

You can claim a deduction for work-related car expenses if you use your own car in the course of performing your job as an employee, for example, to:

- carry bulky tools or equipment (such as an extension ladder) which your employer requires you to use for work and you can't leave at work

- attend conferences or meetings

- deliver items or collect supplies

- travel between two separate places of employment, provided one of the places is not your home (for example, when you have a second job)

- travel from your normal workplace to an alternative workplace and back to your normal workplace or directly home

- travel from your home to an alternative workplace and then to your normal workplace or directly home (for example, if you travel to a client's premises for a meeting)

- perform itinerant work

Note: if you receive an allowance from your employer for car expenses, you should be aware that this is assessable income and must be included on your tax return. This allowance will usually be shown on your payment summary.

Calculating your deductions

There are two methods that can be used to calculate your travel deduction. Тhe Australian working holiday cent per kilometre method and the logbook method.

Cents per kilometre method

Under the cents per kilometre method individuals can use 85 cents per kilometre (in 2023/24) for all motor vehicles. However, you can only claim a maximum of 5,000 business kilometres per car.

While it's not necessary to have written evidence, you will need to be able to show how you worked out your business kilometres (for example, by producing diary records of work-related trips).

If you share a car with another user for separate income-producing purposes, the two of you can claim up to a maximum of 5,000 kilometres.

Logbook method

All motor claims must be based on the business-use percentage of the expenses for the vehicle.

Expenses can include running costs and decline in value but not capital costs, such as the purchase price of your car, any money borrowed to buy it and any improvement costs.

To work out your business-use percentage, you'll need to use a logbook and record the odometer (measures the distance travelled by a car) readings for a minimum continuous period of 12 weeks.

You can claim fuel and oil costs based on either your actual receipts or, alternatively, you can estimate the expenses based on odometer records that show readings from the start and the end of the period you had the car during the year.

You need written evidence for all other expenses for the car.

Work-related car expenses

Owned or leased cars

You can claim a deduction for using a car that you owned, leased or hired under a hire-purchase agreement while on your Australian working holiday.

You can't be considered to own or lease the car if you do not make financial contributions such as the initial purchase, lease, hire-purchase agreements, and loan or lease payments – even though you pay for expenses such as registration, insurance, maintenance or other running costs.

If you have a family or private arrangement where you are effectively the owner of the car, even if you are not the registered owner, you can still claim expenses.

Damage caused to third party motor vehicle in the course of your employment

You may also be entitled to deductions for costs you incurred if you are:

- involved in an accident which causes damage to a third-party vehicle, and

- liable for the damages/compensation for the damage caused to the other vehicle, you may be entitled to a deduction for the costs you incurred

Where an accident occurs in the course of producing your assessable income, the expenses associated with the liability to pay for the damage to the other vehicle involved in the accident are incidental and relevant to the production of your assessable income. They are not capital, private or domestic.

Other travel expenses

Other travel expenses you may be able to claim include:

- travel expenses you incurred for meals, accommodation and incidentals while away overnight for work, such as going to a work conference (generally, you can't claim for meals if your travel did not involve an overnight stay)

- the costs you actually incur (such as fuel costs) when using a borrowed car or a vehicle other than a car for work purposes

- air, bus, train, tram and taxi fares

- car-hire fees

Note: If your travel expenses are reimbursed you can't claim a deduction.

If you receive a travel allowance

If you are paid a travel allowance:

- you must declare the allowance on your tax return as income

- you are entitled to claim a deduction for the actual expenses you incur, less any private component

If you get paid an allowance for some travel expenses (including overtime meal allowances, and domestic and overseas travel allowances), you don't have to keep written evidence of your expenses provided your claim does not exceed the reasonable allowance amount set for each year.

If you want to claim more than the reasonable allowance amount, you need to keep evidence of your expenditure.

Mark works for a delivery company in Perth. His employer asks him to visit conferences, events and meetings located in Adelaide once a month. Due to the long distances of travel involved and the length of the events, Mark has to sleep away from home for three nights on each trip.

Mark's employer pays him an allowance of $150 per night to cover accommodation, meals and incidental expenses and includes the allowance on his payment summary.

As Mark's employer has shown the travel allowance on his payment summary, he must include that allowance in his assessable income on his tax return.

Mark can claim a deduction for the amount he spends on meals and accommodation without providing receipts or other written evidence, as long as his claim does not exceed the reasonable allowance amount (Adelaide daily total - $285.70).

Mark can't automatically claim the reasonable amount as a deduction just because he has received an allowance. He can only claim the amount he spends on accommodation, meals and incidental expenses.

And, if Mark wants to claim more than the reasonable allowance amount, he will need to provide written evidence for all his expenses.

However, even if Mark relies on the exception from providing receipts or other written evidence, he may still be required to show the basis for determining the amount of his claim, that he spent the money, and that it was for work-related purposes.

Accommodation allowances and expenses

As a general rule, you must declare any travel allowance you receive as income in your tax return. This holds true for individuals on an Australian working holiday.

You do not have to declare a travel allowance as income in your tax return if:

- the travel allowance is not shown on your payment summary

and

- you spent the allowance on deductible accommodation costs (and meal and incidental expenses, if applicable)

If you don't declare your allowance as income, you can't deduct your accommodation costs (and meal and incidental expenses, if applicable) – even if they are more than your allowance.

You can deduct your accommodation costs (as well as meal and incidental expenses) if all of the following apply:

- you declare any travel allowance you receive as income on your tax return

- you are required as part of your employment duties to travel away from home

- you are only working away from home for relatively short periods of time (you are not living away from home)

- you did not incur the expenses because of a choice you made to maintain your residence in a different location to your place of employment

- you have a permanent home at a location away from the work location to which you are travelling

- you pay for the accommodation yourself and are not reimbursed for the costs you incur

To claim a deduction, you'll need to keep written evidence to account for your costs.

However, you won't need to substantiate the costs if you have received a travel allowance for travel within Australia and the deduction you claim for accommodation (and meals and incidental expenses, if applicable) is equal to or less than the reasonable travel allowance.

Even where you don't need to substantiate your costs, you may still be asked to show the following:

- you paid the expense yourself

- the cost is deductible – you met the conditions required to deduct the expense

- you received a travel allowance

- you stayed in short-term commercial accommodation

Expenses for accommodation you purchase or rent

Rather than stay in a hotel, motel or serviced apartment, you may instead be staying in rented accommodation or in accommodation that you purchased.

The costs of financing, holding and maintaining accommodation you purchase or rent to stay in when you travel for work may be deductible as work-related travel expenses.

You must declare any travel allowance you receive as income in your tax return if you want to claim a deduction for your accommodation costs (as well as meal and incidental expenses).

You can claim:

- rent

- interest on loans used to purchase the accommodation

- rates

- taxes

- insurance

- general maintenance of the accommodation

- the depreciation of certain assets, such as furniture and household equipment

You can't claim costs relating to capital expenses such as the costs of purchasing or renovating the accommodation purchase costs of furniture, household equipment and other assets for the accommodation.

You might have to apportion your costs of financing, holding and maintaining accommodation you purchase or rent if either:

the costs are disproportionate to what you would have spent on suitable commercial accommodation for the period of travel

the accommodation is used for private or domestic purposes and not wholly for work related travel

Note: You can't claim a deduction for the cost of financing, holding and maintaining your home.

Jane works for a paper and stationery company in Sydney that has a regional office in Melbourne. The company requires her to attend the Melbourne branch for three weeks every second month.

Jane purchases a one bedroom apartment in Melbourne to stay in when she is in the city for work. When she is not there for work, the apartment is vacant. And Jane doesn't use it for private or domestic use during the year.

Jane receives a travel allowance from her employer to cover the cost of accommodation, meals and incidental expenses for the periods she is needed in Melbourne. This allowance is shown on her payment summary.

The costs of financing, holding and maintaining the apartment in Melbourne for the year are not disproportionate to the cost of Jane obtaining suitable short-term accommodation for the same period.

Jane must include the travel allowance as income in her tax return because it is shown on her payment summary. She can also claim a deduction for the costs of financing, holding and maintaining the Melbourne apartment for the year.

Award transport payments

You may receive an allowance from your employer for transport expenses or car expenses that are paid to you under an award. This is assessable income and must be included on your tax return. You may also be able to claim a deduction for work-related transport expenses covered by these payments.

To work out how much you can claim, you need to know the award amount as this affects whether you need written evidence to support your claim.

If you choose to claim no more than the award amount, you don't need written evidence.

If you want to claim more, you will need written evidence for the whole of your claim.

Clothing and laundry expenses

You can claim a deduction for the cost of buying and cleaning occupation-specific clothing, protective clothing and unique, distinctive uniforms as part of your Australian working holiday expenses.

To make a deduction you may need to have written evidence that you purchased the clothing and diary records or written evidence of your cleaning costs.

If you receive an allowance from your employer for clothing, uniforms, laundry or dry-cleaning, you will need to display the amount of the allowance on your tax return, adhering to Australian tax regulations.

Occupation-specific clothing

You can claim deductions for clothing that is specific to your occupation (and not every day in nature) and allows the public to easily recognise your occupation.

However, you can't claim the cost of purchasing or cleaning clothes you bought to wear for work that are not specific to your occupation. Examples of ineligible clothing expenses include a business person's suit or a swimming instructor's swimwear.

Protective clothing

You can claim for clothing and footwear that you wear to protect yourself from the risk of illness or injury associated with your work. To be considered protective, the items must provide a sufficient degree of protection against that risk.

Examples of protective clothing include:

- fire-resistant and sun-protection clothing

- safety-coloured vests

- steel-capped boots, gloves, overalls, and heavy-duty shirts and trousers

- overalls, smocks and aprons worn to avoid damage or soiling to your ordinary clothes during your work

Work uniforms

You can claim a deduction for a uniform, either compulsory or non-compulsory, that is unique (it has been designed and made only for the employer) and distinctive to the organisation you work for.

However, you can't claim the cost of purchasing or cleaning a plain uniform which is not specific to an employer.

Compulsory work uniform

This is a set of clothing that identifies you as an employee of a particular organisation. That organisation must have a strictly enforced policy that makes it compulsory for you to wear the uniform while you're at work.

You may also be able to claim a deduction for shoes, socks and stockings if they are an essential part of a distinctive compulsory uniform, and their characteristics (colour, style and type) are specified in your employer's uniform policy.

Alternatively, you may be able to claim for a single item of distinctive clothing, such as a jumper, if it's compulsory for you to wear it at work.

Non-compulsory work uniform

You can't claim expenses incurred for non-compulsory work uniforms unless your employer has registered the design with AusIndustry (specialist business program delivery division in the Department of Industry, Innovation, Science, Research and Tertiary Education).

However, shoes, socks, stockings and single items (such as a jumper) are never considered part of a non-compulsory work uniform and can't be considered for a deduction, aligning with working holiday tax guidelines.

Cleaning of work clothing

It's possible to count the cost of washing, drying and ironing eligible work clothes, (or having them dry-cleaned) as an eligible deduction.

However, you will need to have written evidence (such as diary entries and receipts) for your laundry expenses if:

- the amount of your claim is greater than $150

and

- your total claim for work-related expenses exceeds $300 - not including car, meal allowance, award transport payments allowance and travel allowance expenses

Reasonable basis

If you don't have to provide written evidence for your laundry expenses, it's a good idea to use the 'reasonable basis' to work out your claim.

For washing, drying and ironing you do yourself, the below is considered to be a reasonable basis for working out what your laundry claim is:

- $1 per load - this includes washing, drying and ironing - if the load is made up only of work-related clothing,

and

- 50 cents per load if other laundry items are included

Note: If you choose another basis to work out your claim, you may be asked you to explain that basis.

Dry-cleaning expenses

You can also claim the cost of dry-cleaning work-related clothing as a deduction. However, If your total claim for work-related expenses exceeds $300 - not including car, meal allowance, award transport payments allowance and travel allowance expenses - you will need to have written evidence to substantiate your claim.

Gifts and donations

Deductions for gifts are claimed by the person that makes the gift (the donor).

In Australia only certain organisations are entitled to receive tax deductible gifts. These organisations are commonly referred to as 'deductible gift recipients' (DGRs).

In other words, it's only possible to claim a tax deduction for gifts or donations to organisations that have a DGR.

If you would like to claim a deduction, your gift must meet four conditions.

1) The gift must be made to a DGR

2) The gift must truly be a gift - ie the donor receives no material benefit or advantage by giving the gift

3) The gift must be money or property, which includes financial assets such as shares

4) The gift must comply with any relevant gift conditions. For some DGRs, the income tax law adds extra conditions affecting types of deductible gifts they can receive

How much can be claimed

This depends on the type of gift that you give.

Gifts of money - you can claim the amount of the gift, as long as it is $2 or more

Gifts of property - differing rules, depending on the type and value of the property

Bushfire and flood donations - if you made donations of $2-$10 to bucket collections conducted by an approved organisation for bushfire and flood victims, you can claim a tax deduction equal to your contribution without a receipt

Usually, a tax deduction for most gifts is claimed in the tax return for the income year in which the gift is made. However, in certain circumstances, it's possible to spread the tax deduction over five income years.

Home office expenses

You may be entitled to claim eligible home expenses as a deduction on your tax bill, particularly if you are on an Australian working holiday.

Examples of home expenses include; a computer, phone or other electronic devices you are required to use for work purposes, as well as a deduction for running costs.

Generally, as an employee, you can't claim a deduction for occupancy expenses. Examples of occupancy expenses include rent, mortgage interest, council rates and house insurance premiums.

Running costs

If you do some of your work in a home office, you may be entitled to a deduction for the costs you incur. Examples of eligible deductions include:

- home office equipment, such as computers, printers and telephones, the cost (for items costing up to $300) or decline in value (for items costing $300 or more)

- work-related phone calls (including mobiles) and phone rental (a portion reflecting the share of work-related use of the line) if you can show you

1) are on call, or

2) have to phone your employer or clients regularly while you are away from your workplace

- heating, cooling and lighting

- the costs of repairs to your home office furniture and fittings

- cleaning expenses

Records you must keep

If you would like to claim deductions for home expenses you will need to keep detailed records while on your working holiday in Australia, such as:

- receipts or other written evidence of your expenses, including receipts for depreciating assets you have purchased

- diary entries you make to record your small expenses ($10 or less) totalling no more than $200, or expenses you can't get any kind of evidence for, regardless of the amount

- itemised phone accounts from which you can identify work-related calls, or other records, such as diary entries (if you do not get an itemised account from your phone company)

- a diary you have created to work out how much you used your equipment, home office and phone for business purposes over a representative four-week period

Interest, dividend and other investment income deductions

You can claim a deduction for expenses incurred in earning interest, dividend or other investment income.

However, you can't claim a deduction for receiving an exempt dividend or other exempt income. If you attend an investment seminar, you are only entitled to claim a deduction for the portion of travel expenses incurred in connection with your investment income activities.

Interest income expenses

You can claim account-keeping fees where the account is held for investment purposes – for example, a cash management account. You will find these fees listed on your statements or in your passbooks.

If have a joint account, you can only claim your share of fees, charges or taxes on the account. For example, if you hold an equal share in an account with your spouse, you can only claim half of any allowable account-keeping fees paid on that account.

Dividend and share income expenses

You can claim a deduction for interest charged on money borrowed to purchase shares and other related investments from which you derived assessable interest or dividend income.

Only interest expenses incurred for an income-producing purpose are deductible.

If you used the money you borrowed for both private and income-producing purposes, you must apportion the interest between each purpose.

Do claim

- ongoing management fees or retainers and amounts paid for advice relating to changes in the mix of investment

- a portion of other costs if they were incurred in managing your investments, such as:

- travel expenses

- the cost of specialist investment journals and subscriptions

- borrowing costs

- the cost of internet access

- the decline in value of your computer

- If you were an Australian resident when a listed investment company (LIC) paid you a dividend, and the dividend included a LIC capital gain amount, you can claim a deduction of 50% of the LIC capital gain amount

Don't claim

- fees charged for drawing up an investment plan unless you were carrying on an investment business

- some interest on money borrowed to purchase shares, units in unit trusts and stapled securities, which is attributable to capital protection under a capital protected borrowing, is not deductible and is treated as a payment for a put option

Forestry managed investment scheme deduction

If you make payments to a forestry managed investment scheme (FMIS), you may be able to claim a deduction for these payments if you:

- currently hold a forestry interest in an FMIS, or held a forestry interest in an FMIS during the income year

and

- have paid an amount to a forestry manager of an FMIS under a formal agreement

You can only claim a deduction if the forestry manager has advised you that the FMIS satisfies the 70% direct forestry expenditure rule in Division 394 of the Income Tax Assessment Act 1997.

Tools, equipment and other assets

If you buy tools, equipment or other assets to help you to earn your income, you are entitled to claim a deduction for some or all of the cost.

If the tools are used for both work and private purposes you will need to apportion the amount you claim. For example, if you have a computer for your graphic design business which is also used for private purposes half of the time, you can only deduct 50% of the cost as this is the amount of time that was used for business purposes.

The type of deduction you claim depends on the cost of the asset:

- for items that don't form part of a set and cost $300 or less, or form part of a set that together cost $300 or less, you can claim an immediate deduction for their cost

- for items that cost more than $300, or that form part of a set that together cost more than $300, you can claim a deduction for their decline in value

Examples of tools, equipment or assets:

- calculators

- computers and software

- desks, chairs and lamps

- filing cabinets and bookshelves

- hand tools or power tools

- protective items, such as hard hats, safety glasses, sunscreens and sunglasses

- professional libraries

- safety equipment

- technical instruments

You can also claim the cost of repairing and insuring your tools and equipment as well as any interest on money you borrowed to purchase these items.

If you use items for both personal and work-related purposes you need to keep a detailed records (such as a diary) so that you can show, if required, how you apportioned the amount of private use and work-related use.

Want to Learn More About Australian Tax?

DOWNLOAD YOUR FREE TAX GUIDE HERE

Self-education expenses

You may be able to claim a deduction for self-education expenses if your study is work-related.

For example, if you do a course for bar work on construction. Common items also include courses such as RSA (Responsible Service of Alcohol), RCG (Responsible Gambling Training) and White Cards (for safe work on Australian construction sites).

Eligible courses

Self-education expenses are deductible when the course leads to a formal qualification and meets the following conditions:

- The course must have a sufficient connection to your current employment and maintain or improve the specific skills or knowledge you require in your current employment or

- Result in or likely to result in an increase in your income from your current employment

You can't claim for self-education expenses for a course that doesn't have sufficient connection to your current employment even though if it might be generally related to it or enables you to get new employment.

To use these as deductions, you must add up your self-education expenses under a certain category because, in working out what you can claim, certain costs are reduced by $250.

You can claim the following expenses in relation to your self-education:

- Accommodation and meals (if away from home overnight)

- Computer consumables

- Course fees

- Decline in value for depreciating assets (cost exceeds $300)

- Purchase of equipment or technical instruments costing $300 or less

- Equipment repairs

- Fares

- Home office running costs

- Interest

- Internet usage (excluding connection fees)

- Parking fees (only for work-related claims)

- Phone calls

- Postage

- Stationery

- Student union fees

- Student services and amenities fees

- Textbooks

- Trade, professional, or academic journals

- Travel to-and-from place of education (only for work-related claims)

Some travel for journeys cannot be claimed, but you may be able to offset the cost of these journeys against the $250 reduction.

If an expense is partly for your self-education and partly for other purposes, you should only claim the amount that relates to your self-education as a deduction.

Other deductions

As a general rule of thumb, if you need to spend money to earn income, you can usually claim it – either as an immediate deduction or over time.

To be a legitimate expense claim, you have to be able to show:

- you need to incur the expense in order to earn the income

- the expense is not private or domestic in nature

- the expense is not an outgoing of capital or of a capital nature related to a capital asset

Records you need to keep

During the financial year you'll receive documents that are important for doing your tax, such as payment summaries, receipts, invoices and contracts. Generally, you need to keep these for five years from when you lodge your tax return in case you are required to substantiate your claims.

Examples of records you need to keep:

- payment summaries from payers, including your employer and the Department of Human Services - this is known as 'Services Australia'

- statements from your bank and other financial institution showing the interest you've earned

- dividend statements from companies

- summaries from managed investment funds

- receipts or invoices for equipment or asset purchases and sales

- receipts or invoices for expense claims and repairs

- contracts

- tenant and rental records

Note: Your documentation must be in English, unless you incurred the expense outside Australia.

If your total claim for work-related expenses is more than $300, you must have written evidence to prove your claims.

If you acquire a capital asset - such as an investment property, shares or managed fund investment it's a good idea to start keeping records immediately because you may have to pay Capital Gains Tax if you sell the asset in the future. Keeping records from the start will ensure you don't pay more tax than necessary.

Our average Australian tax refund is AU$2600

Paying tax and lodging a tax return

30 June marks the end of the Australian income year. After this date you lodge your annual tax return to detail how much income you received and the tax that you paid on it.

You will then be entitled to receive a tax refund if you're due one.

Use our free tool to calculate your tax return in Australia.

Who needs to lodge a tax return?

You'll need to lodge an Australian tax return if any of the following apply:

- Tax was deducted from any payments (such as wages) that you received during the financial year

- You are an Australian resident and your taxable income was more than the tax-free threshold

- You are a foreign resident and you earned more than $1 in Australia during the financial year

- You are leaving Australia permanently or for more than one financial year

However, you do not need to lodge an Australian tax return if you are a foreign resident and your only Australian-sourced income was interest, dividends or royalties from which non-resident withholding tax has been correctly withheld.

Lodging your return – how and when

30 June marks the end of the Australian income year. After this date you have from 1 July to 31 October to lodge your tax return for the previous income year, streamlining the process for those with specific financial situations during their Australian working holiday.

There are three main options you can choose from in order to file your tax return.

Option 1 – Online

You can file your tax return and apply for your refund directly yourself online.

When you create and log into your myTax account you will see that most information from your employer, bank and government agencies will be pre-filled by late August and this will be useful for you to file your return.

Option 2 – Lodge a paper tax return

It's also possible to lodge a paper tax return by mail.

To lodge a paper tax return you will need:

- the Individual tax return instructions (more below)

and

- a copy of the paper Tax return for individuals

Note: you will also need to lodge the Tax return for individuals (supplementary section) if you have:

- distributions from a partnership or trust

- capital gains

- foreign source income

- rental income

Individual tax return instructions

The Individual tax return instructions and Individual tax return instructions supplement are designed to help you to complete your tax return.

Option 3 – File through a registered tax agent

If you use a registered tax agent, like Taxback, to prepare and lodge your tax return, you can lodge later than 31 October.

Taxback have over 20 years of experience in getting Oz tax back for backpackers, 417 visa holders, students and working holidaymakers. We can file your tax return for you and ensure that you receive your maximum legal tax refund in compliance with Australian tax regulations.

Our average Australian tax refund is AU$2,600.

Our average Australian tax refund is AU$2600

How do I know if I will get a refund?

One way to find out if you're due a refund is by using the Taxback no-obligation tax refund calculator. It's completely free to get an estimate of your refund here.

Our average Australian tax refund is AU$2600

Amending tax returns or fixing a mistake

If you file a tax return yourself and you think you made a mistake or you forgot to include something, you can amend your tax return by logging on to myGov.

Online amendments are generally processed in four weeks, compared to paper amendments which take 10 weeks. You can amend multiple times if needed.

Lodging a tax return early

If you leave Australia permanently before 30 June, you can choose to lodge your tax return early.

Key terms

DASP

DASP stands for 'Departing Australia Superannuation Payment'. If you are or were on a temporary visa in Australia (except subclasses 405 and 410) and don't intend to retire there, you are entitled to claim back your superannuation. The average super refund from Taxback is $1,908.

The average superannuation refund is $1908

Expenses

There are a number of deductions you can make when filing a tax return to reduce your overall tax liability. These include:

- Vehicle & travel

- Clothing & laundry

- Home office costs

- Tools, equipment & other assets

Records

During the financial year you'll receive documents that are important for doing your tax, such as payment summaries, receipts, invoices and contracts. Generally, you need to keep these for five years from when you lodge your tax return in case you are required to substantiate your claims.

Superannuation

Superannuation is a system for employees in Australia to collect enough funds to replace their income in retirement. Everyone over the age of 18, who earns more than $450 per month (before tax), must have a super fund. Their employer must pay 11% of the value of their ordinary time earnings into a super fund.

Tax rates

The tax rates for working holidaymakers are:

- $0–$45,000 - 15c for every $1

$45,001–$120,000 - $6,750 plus 32.5c for each $1 over $45,000

$120,001–$180,000 - $31,125 plus 37c for each $1 over $120,000

$180,001 - $53,325 plus 45c for each $1 over $180,000

Tax refund

There are many reasons why working holidaymakers may be entitled to a tax refund. You are entitled to apply for your refund when you file your tax return. The average tax refund from Taxback is $2,600.

Tax return

If you earn less than $45,000 per year during your working holiday in Australia, you are not legally required to file a tax return. However, the vast majority of working holidaymakers are entitled to claim a tax refund. By lodging your tax return, you can claim your tax refund. The average Australian refund a Taxback customer receives is $2,600. Tax returns cover the financial year from 1 July to 30 June of the following year, and if you're lodging your own return, the deadline is 31 October.

TFN

TFN stands for 'tax file number'. Your tax file number (TFN) is your personal reference number in both the tax and Superannuation systems.

Trans-Tasman Retirement Savings Portability Scheme

New Zealand citizens and permanent residents of Australia are not eligible for the Departing Australia Super Payment. The Trans-Tasman Retirement Savings Portability Scheme permits transfers of retirement savings between super funds for people who emigrate from one country to the other.

Visa

There are two visa subclass options that prospective working holidaymakers to choose to apply for.

- Visa 417 (Working Holiday)

- Visa 462 (Work and Holiday) (backpackers)

Withholding amounts

If you do not supply your Tax File Number (TFN) to your employer when you start your job they must withhold 45% (to the nearest dollar) of your wages regardless of your level of income no matter the income.

Working Holiday Visa FAQ

Q - I'm in Australia on a 462 working holiday visa. Do I have to file a tax return?

A - If you earn less than $45,000 per year during your working holiday in Australia, you are not legally required to file a tax return. However, the vast majority of working holidaymakers are entitled to claim a tax refund. By filing your tax return, you can claim your tax refund. The average Australian refund a Taxback customer receives is $2,600.

Q - When is the deadline for filing?

A - The Australian financial year runs from 1 July to 30 June of the following year and your tax return covers this period. If you're lodging your own return, the deadline is 31 October.

Our average Australian tax refund is AU$2600

Q - How can I tell if I am a resident or non-resident for tax purposes?

A - The majority of Australian working holidaymakers are considered foreign residents for tax purposes.

The main requirement to be deemed a resident for tax purposes is that you have continuously resided in Australia for a period of 183 days (6 months). When you file your tax return you will be asked to complete a residency questionnaire and the purpose of this is to establish your correct tax residency designation.

Q - What's the difference between an ABN and TFN?

A - An ABN is an Australian Business Number and every business operating in Australia needs to have one. Also, all self-employed people are required to have an ABN and quote it on invoices for work performed. Common examples of occupations where an ABN might be required are trades such as carpentry, fundraising, and personal training.

A TFN is a Tax File Number which is required by anybody who wants to work in Australia. This number is given to all employees when you start working and your employer will then deduct tax from your income under the PAYG (Pay As You Go) system. Because tax is taken at source by your employers, generally speaking people don't need to worry about having a tax liability at the end of the year.

Here is a dedicated article about working on both ABN and TFN.

Q - Lodging a tax return? No way! That sounds like too much hard work! What happens if I just don't lodge a return?

A - If you do not lodge a tax return, you may be liable to pay fines and penalties. You will also miss out on claiming your tax refund if you don't file a return.

But filing a tax return is actually pretty easy, especially if you file with Taxback. The average tax reclaim in Australia is $2,600.

Q - What documents will I need in order to file my return and claim my refund?

A - It is a good idea to keep a hold of the below documents as you may need them when you are filing your return.

- Payslips – your final payslip from each job is the most important so keep it safe!

- Invoices - If you plan to work for yourself make sure you keep all of your invoices and ensure they account for all work completed

- Proof of Australian address – examples include bank statements, TFN statement, Lease Agreement, Gym Membership, Phone or Utility Bill

- Work-related expense receipts – e.g. for Uniform, Work Courses, Tools/Equipment or Car/ transport

Want to Learn More About Australian Tax?

DOWNLOAD YOUR FREE TAX GUIDE HERE

Q - I have lost most of my payslips. What can I do?

A - You can ask your employer for a PayG Summary at the end of the financial year. Alternatively, Taxback can help you to retrieve your lost documents.

Q - What is Superannuation?

A - Superannuation is a system for employees in Australia to collect enough funds to replace their income in retirement.

Q - How can I tell if I'm supposed to pay Superannuation?

A - If you earn over $450 per month in Australia your employer is legally obliged to pay into a superannuation (super) fund for you. They should be paying 11% of your basic earnings (in addition to your wages) into a nominated superannuation fund.

Q - I plan to travel around Australia and work in a number of different jobs. How will each employer know how to pay my super into the same fund?

A - They won't! Not unless you tell them that is. Many employers will have a default super fund that they will pay into. This means that if you have four different employers, you'll have four different super funds and things can get confusing. Alternatively, you can set up your own fund and advise your employer to pay your super into it. To do this you'll need to give your employer the name of your fund and your member number.

Q - I have no intention of retiring in Australia. Can I get my super back?

A - Yes. But, you can only claim your superannuation refund (Departing Australia Superannuation Payment - DASP) when you have left Australia or your visa has expired.

However, before your super is paid to you, tax will be deducted. If your Departing Australia Superannuation Payment is processed on or after 1 July 2017, your superannuation refund will be taxed at a rate of 65%. If your superannuation refund is processed before 1 July 2017, then your superannuation refund will be taxed at a rate of 35%.

And if you have one super fund, rather than numerous funds, it will be easier to process your DASP. The average super refund from Taxback is $1,908.

The average superannuation refund is $1908

Q - How long does it take to get a refund?

A - It takes around 10-12 weeks to process our income tax refund. Once at the superannuation fund office, your application should take up to 12 weeks to process.

Further information on refunds can be found here.

Q - Can I go back to Australia if I claim my Superannuation?

A - Yes. You can apply to return to Australia on another visa even if you claim and receive your superannuation refund.

Q - I applied for an income tax refund before but I wasn't happy with how much I got - can I apply again?

A - If you filed an Australian tax return in the last 2 years with another company or on your own and you're not satisfied with what you got back, Taxback can look into this for you. We can assess for free whether you are owed a bigger tax refund than you received. Use our tax refund calculator now!

Our average tax refund is AU$2,600. Get your refund today!